News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

arack

Obama spent the last 45 months blaming

former President George W. Bush for the bad economy. And because

he has no record of his own to run on, Obama will campaign for

the next 60 days or so on the slogan "It's Bush's Fault."

But is it? Granted the subprime mortgage industry, which caused

the financial meltdown in the United States that was created on Bill

Clinton's watch, collapsed on Bush-43's watch. However, if

you follow the dots back far enough you will discover that it is, in reality,

Obama's fault since his community activism in Chicago engineered

the subprime mortgage debacle by convincing some politicians that generational

welfare recipients should be able to enjoy the dream of home ownership

although they lacked the credit worthiness to qualify for a mortgage.

With the help of former President Clinton, Jimmy Carter's Community

Reinvestment Act of 1977 (Public Law 96-128, 91 Stat 1147, 12 USC

2901) was amended in 1993 to loosen credit standards for minority home

buyers, creating what became the subprime mortgages of 1999-2005.

arack

Obama spent the last 45 months blaming

former President George W. Bush for the bad economy. And because

he has no record of his own to run on, Obama will campaign for

the next 60 days or so on the slogan "It's Bush's Fault."

But is it? Granted the subprime mortgage industry, which caused

the financial meltdown in the United States that was created on Bill

Clinton's watch, collapsed on Bush-43's watch. However, if

you follow the dots back far enough you will discover that it is, in reality,

Obama's fault since his community activism in Chicago engineered

the subprime mortgage debacle by convincing some politicians that generational

welfare recipients should be able to enjoy the dream of home ownership

although they lacked the credit worthiness to qualify for a mortgage.

With the help of former President Clinton, Jimmy Carter's Community

Reinvestment Act of 1977 (Public Law 96-128, 91 Stat 1147, 12 USC

2901) was amended in 1993 to loosen credit standards for minority home

buyers, creating what became the subprime mortgages of 1999-2005.

So, while Obama blames

the current financial meltdown and the skyrocketing unemployment that

resulted from it on Bush-43's watch—much the way Herbert

Hoover was blamed from the Stock Market Crash on Oct. 29 which was

deliberately orchestrated by the princes of industry and the barons of

banking to take the United States off the gold standard. Hoover,

a trained engineer and one of the best administrators in the country,

was blamed for the Great Depression by the far left academicians who are

the caretakers—and revisionists—of history.  Hoover's

recession and Hoover's depression were

caused by Franklin D. Roosevelt for trying to spend his way out

of a recession. Today, that's Obama's problem. You can't spend

your way into prosperity using borrowed money.

Hoover's

recession and Hoover's depression were

caused by Franklin D. Roosevelt for trying to spend his way out

of a recession. Today, that's Obama's problem. You can't spend

your way into prosperity using borrowed money.

The gamebook the completely inexperienced and totally inept Obama is using to spend his way out of this recession was written by FDR 79 years ago. History proved FDR's solution didn't work. Why? Because it's humanly impossible to spend your way into prosperity. The wealth you possessed is transferred to whomever buys your debt bonds. In this case, that would be China.

History assigned the blame for the Great Depression to Hoover simply because the academicians who chronicle who did what, said he did. In their world, you always blame the other guy because the problem started on his watch. FDR's spending changed Hoover's Recession into a Depression so severe it took a world war to bring us out of it. Why? Because you can't buy your way out of a Recession. But you can buy your way into a Depression. According to CBS News, Obama is increasing the national debt by $573,160,162, 546.29 a month. What's more, Obama is on a printing spree unmatched since the Weimar Republic decided to pay off its World War I war reparations with money backed by nothing except paper and ink since Hitler, like Obama, made the banks buy his Treasury Notes with the same hyperinflated dollars he was creating.

What caused the hyperinflation in Germany was a provision in the Treaty of Versailles which ended the war. The Treaty mandated that the Weimar Republic pay off its war debts with gold, silver or foreign currency, but not German Marks (fearing precisely what happened). When Germany began buying foreign currency with German currency, the value of the Mark plummeted, causing a need to print more German Marks. The rest, as they say, is history. Obama has already started down the same road traveled by the Weimar Republic—which, by the way, led Germany to Adolph Hitler. Only, the United States is not paying off war reparations but economic reparations. And the debt holder is the People's Republic of China.

What is interesting about Obama's Debt is that the total accumulated historic unpaid national debt when Obama was handed the key to the Oval Office was $10,699,804,864,612.13. In three years, the Obama-Pelosi-Reid spending cartel increased the national debt by another $5,300,736,228,779.78. It took the country 225 years to accumulate a debt of $10.7 trillion. In 3.5 years, Barack Obama added 50% more, bringing the debt your children, grandchildren and great, great grandchildren will be expected to pay to $15,990,541,092,391.91 [the national debt on Sept. 2, 2012. That debt now exceeds $16 trillion.) Who got the money? Add Walmart "smiley faces" to the photos of a lot of investment bankers and a lot of watermelons (businessmen and environmentalists who are green on the outside, communist red on the inside) campaign, contributors and bundlers whose quid pro quos from the Obama Administration make it a certainty that they won't ever have to worry about their children going to bed hungry, or experience the fear of having their summer homes or winter chalets foreclosed because they can't pay the mortgage.

Each year you—Mr. and Mrs. Taxpayer—are forced to pay the Federal Reserve a little over $150 billion in interest on that debt. When Barack Obama promised the American people "change," it was the one campaign promise he kept. Obama changed the fortunes of every man, woman and child in this country—and none for the better because at the end of the month, when the bills are paid, most Americans find all they have left—if they were able to pay all of the bills—is pocket change. A select few are now better off. Bankers, industrialists, and the Marxist greenies who bankrolled Obama's 2008 election campaign. Solyndra was one of them. The California-based solar panel manufacturer tried to get a low-interest loan from the Bush-43 Administration but it was failing worse than Hillary Clinton's presidential campaign. Bush-43 Energy Secretary Sam Bodman turned them down.

After 20 visits to the Obama

White House to remind Obama that Solyndra shareholder

and Obama bundler George Kaiser had invested hundreds of

thousands of dollars in his campaign, Obama's Energy Secretary

Steven Chu gave them $536 million in taxpayer funds from the stimulus

slush fund that was supposed to be used to save the homes of downsized

American workers.  Obama's

quid pro quo to Solyndra put close to 25,000 Americans in jeopardy

of losing their home. Giving TARP money to General Motors and Chrysler

probably cost another 74,000 taxpayers their homes. But, don't worry.

GM paid off their $14 billion loan. Early. Not from their stellar automotive

sales. From dollars from a $35 billion second stimulus loan from Treasury

that followed the first one. GM, like the nine largest banks in America,

was simply too big to fail. The taxpayers are not. They're expendable.

Obama's

quid pro quo to Solyndra put close to 25,000 Americans in jeopardy

of losing their home. Giving TARP money to General Motors and Chrysler

probably cost another 74,000 taxpayers their homes. But, don't worry.

GM paid off their $14 billion loan. Early. Not from their stellar automotive

sales. From dollars from a $35 billion second stimulus loan from Treasury

that followed the first one. GM, like the nine largest banks in America,

was simply too big to fail. The taxpayers are not. They're expendable.

When the Pelosi-Reid 110th Congress enacted TARP, a process completely lacking any semblance of bipartisanship since Pelosi arbitrarily eliminated Republican participation in the process simply because she could. Controlling every phase of the reconciliation when the House and Senate meet to iron out the differences between House and Senate bills, Reid and Pelosi made sure the Democrats left enough loopholes in the stimulus language that the bankers and bureaucrats in Treasury could easily drive their limousines through them.

The first part of TARP committed $350 billion to buy up foreclosed homes whose worthless paper was held by community banks and mortgage loan companies. Under the law, the properties would be surrendered to the Resolution Trust Company who would be charged with the responsibility to dispose of foreclosed properties in such a way that those millions of homes would not negatively impact the real estate market. Taking those mortgages off the books would free up not only mortgage money for future home sales, but loan modifications for downsized homeowners struggling to save their home in a faltering economy. It would free up dollars for consumer credit to keep the economy growing. Specific language to "offer" home loan modifications to between 3 to 4 million homeowners was in the bill. But, the language in the legislation that was signed into law did not appear to require banks to approve loan modifications for any of those who applied for them—only offer them. The banks took that provision literally.

It was interesting how easy Obama made it for banks to apply for, and receive, TARP money. The government eagerly jumped into the deep end of the pool to help banks. But they were reluctant to even tiptoe into the shallow end of the pool to help those whom TARP was actually enacted to save. The Democrats appeared afraid that if they actually modified any mortgages for homeowners in trouble, the following year, 2010, the Republicans would coin the HAMP (Home Affordable Modification Program) equivalent of "welfare queen"—to describe those who applied to Uncle Sam to refinance homes with loans they might not otherwise not qualify for. The Democrats feared the Republicans would say that homeowners flocked to apply for loans so they could add a swimming pool or remodel the garage into an extra bedroom or family room and then have their mortgage modified by the taxpayers.

HUD issued a report on Dec. 31, 2011 trumpeting their success in helping American families through HAMP. HUD claimed they had "helped" 1.5 million families in jeopardy of losing their homes. In reality, after two years, only 646 families had been helped by the HAMP program through HUD.

A year earlier, in October,

2010, looking forward to a tough election,. the Obama Treasury

Dept. issued an internal memo called a "Two Year Retrospective"

which claimed the modification program was a success because there

were nearly 700 thousand failed trial modifications compared to just 467

thousand permanent modifications. It was the view of the US Treasury

and the banking industry that since the law did not spell it out fully,

the Troubled Asset Relief Program was designed only to offer homeowners

"temporary" modification programs, not permanent mortgage modifications.

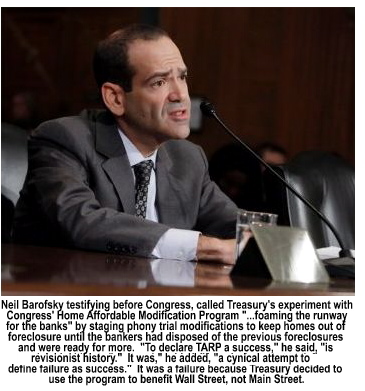

Treasury

seemed to believe that every family that received a "trial modification"

had benefited sufficiently by having their mortgage payments temporarily

reduced. What the Obama Administration, under Treasury Secretary

Timothy Geithner, was doing, according to the Special Inspector

General for TARP's [SIGTARP] Neil Barofsky, was "...foaming

the runway for the banks" by delaying consumer foreclosures until

the banks could fiscally handle them without making themselves insolvent.

Geithner used HAMP as a "grace period" devise to temporarily

stave off foreclosure, not permanently abate the effort to do so. Funds

allocated to HAMP modifications were used to lower the homeowner's mortgage

while they were "considered" for permanent modification.

Treasury

seemed to believe that every family that received a "trial modification"

had benefited sufficiently by having their mortgage payments temporarily

reduced. What the Obama Administration, under Treasury Secretary

Timothy Geithner, was doing, according to the Special Inspector

General for TARP's [SIGTARP] Neil Barofsky, was "...foaming

the runway for the banks" by delaying consumer foreclosures until

the banks could fiscally handle them without making themselves insolvent.

Geithner used HAMP as a "grace period" devise to temporarily

stave off foreclosure, not permanently abate the effort to do so. Funds

allocated to HAMP modifications were used to lower the homeowner's mortgage

while they were "considered" for permanent modification.

By doing that, the banks profits three ways. First, when they foreclosed on the homeowner, the bank sues the foreclosed homeowner for the delinquent payments plus interest and penalties—a debt the homeowner is obligated to pay if he or she ever intends to own another home. Second, HUD reimburses the bank or mortgage company for its loss (i.e., the taxpayers do that); and finally, the bank sells the house to the Resolution Trust Company or to real estate speculators who will likely convert those homes, for the moment, into rental property. The only people who lose are those that TARP and HAMP were created to help.

The pledge on the US Treasury's website which described HAMP as "...a $75 billion loan modification program to help up to 4 million families avoid foreclosure," should have read: "A $50 billion loan modification program to help up to 4 million families postpone foreclosure." In reality, when SIGTARP head Neil Barofsky resigned as Tarp's Inspector General in 2011, only $1 billion of the $50 billion or $75 billion (depending on whose pocket calculator you're using) had been spent to help the taxpayers save their homes.

Over half of those who applied for loan modifications were ultimately declined. When the homeowner was rejected, usually after living with a trial modification for upwards of a year, two things happened. First, the homeowners discovered their homes were already in foreclosure; and second, the homeowners also received a default notice from their mortgage company for a lump sum payment for whatever amount they were originally behind in their mortgage payments, plus interest, and a demand for the difference between their original mortgage payment and the modified amount plus interest, during the "trial" modification..

In the Special Inspector General for TARP's report to Congress, Barofsky referred to Treasury's claim for what it was—"a cynical attempt to define failure as success." Barofsky further noted that "...although HAMP had around 523,000 ongoing permanent modifications by the end of 2010, the housing market was still hemorrhaging with 2.9 million homes receiving foreclosure filings, and the banks repossessing more than one million homes, building off of the historic numbers in 2008 and 2009."

Banks foreclosed on 820,000 homes in 2008 and 918,000 homes in 2009. One million five thousand homes were seized in 2010. During that same period, 250 thousand foreclosures were halted by the federal government's investigation into fraud by lenders in not properly notifying homeowners they were in jeopardy. In thousands of cases, allegations that unethical foreclosure companies had signed the homeowners' names to foreclosure documents were levied by attorneys for the homeowners fighting to protect their homes. In several cases, the mortgage holders were fined due to evidence uncovered by SIGTARP.

Neil Barofsky, who is a lifelong Democrat and was a superstar prosecutor before being tapped for the job of Special Inspector General of TARP, told the Senate Finance Committee on April 20, 2010 that "...to declare TARP a success..." (which Treasury did) "...is revisionist history. TARP was supposed to restore lending. That didn't happen." For Democrats, it's much simpler to ignore the factual truth and find an alternative reality which you can claim you achieved.

In Barofsky's view, the federal government made a commitment to the American people through the Troubled Asset Relief Program to [a] help homeowners by forgiving part of the principle on their mortgage notes based on the current deflated street value of those homes; and [b] to help downsized-homeowners get lower mortgage payments through lowered interest rates so those families would not lose their homes. Not only did that not happen, the Treasury under Timothy Geithner was even less transparent than the Obama Administration as a whole. Congress had already committed $2,189,000,000,000.00—that's trillions—to saving Wall Street. In doing so, Obama converted a recession that had actually rebounded in July, 2008, into a financial crisis that threatened to collapse not only the US dollar but every currency in the world. According to Barofsky (page 162 in his book) the Fed reportedly loaned the banks "too big to fail" another $4.7 trillion in direct loans. In the end, when the chips are cashed in, we will discover that the banks "too big to fail" now have $8.5 trillion in assets, and they are 28% larger than they were before the financial crisis began (56% of the nation's annual output, up from 43% when the financial crisis began).

According to the Housing

and Economic Act of 2008's whose key advocates, Sen. Chris Dodd

[D-CT] and Congressman Barney Fran k [D-MA], TARP was a commitment

to help homeowners escape toxic mortgages and provide those in jeopardy

with venues that would help them save their family homes. That's how the

Democrats got the bill passed.  However,

Obama Assistant Treasury Secretary Herb Allison who was

appointed by Obama to oversee TARP, made the claim to Barofsky

that TARP "...had never been intended to help the 3 to 4 million

homeowners that [Obama] cited in his speech announcing the program

[to allow homeowners] to actually stay in their homes through permanent

modifications. Instead, he said, the goal [of HAMP] had always been to

make 3 or 4 million offers for trial modifications. That claim of such

a meaningless standard for HAMP," Barofsky said in his

book, BAILOUT; How Washington Abandoned Main Street While Rescuing

Wall Street, " seemed particularly callous given the damage being

done by the worsening foreclosure crisis."

However,

Obama Assistant Treasury Secretary Herb Allison who was

appointed by Obama to oversee TARP, made the claim to Barofsky

that TARP "...had never been intended to help the 3 to 4 million

homeowners that [Obama] cited in his speech announcing the program

[to allow homeowners] to actually stay in their homes through permanent

modifications. Instead, he said, the goal [of HAMP] had always been to

make 3 or 4 million offers for trial modifications. That claim of such

a meaningless standard for HAMP," Barofsky said in his

book, BAILOUT; How Washington Abandoned Main Street While Rescuing

Wall Street, " seemed particularly callous given the damage being

done by the worsening foreclosure crisis."

The greed of the bankers in the Fed, in Treasury, and on Wall Street, has no limits. The moment TARP was signed into law, the nation's largest banks lined up for their taxpayer bailout. Only, there was no room in the line for the taxpayer that TARP was designed to help. While the bankers would like us to believe that the subprime mortgage industry perpetuated the financial crisis that evolved into a global financial debacle, the reality is the greed of the princes of industry and the barons of banking's caused the crisis by attempting to harness the human capital of the third world to create a fluid global economy at the expense of the industrialized nations. The princes of industry and the barons of banking were convinced they could have their cake and eat it, too. They miscalculated. They forgot one thing. When they exported their factories and their jobs to the human capital in the third world, they never asked: "Where are their former employees going to find the jobs they need to produce the income required to purchase the products their former employees were now making with slave labor to send back to the United States for sale?"

They assumed a resilient America would deflect the economic shock of boarded-up factories by using American ingenuity to initiate a small business manufacturing renaissance that would save the nation. They thought so because that's always been what Americans did. What the bankers and industrialists failed to factor into the equation was their natural ally and also their nemisis—labor unions—would always work against free enterprise America. With the Democratic Party controlling Congress for 80 out of the last 100 years due largely to the efforts of labor unions which, in return, received from the Democrats lopsided labor laws that defanged business while providing labor with almost unparalleled muscle.

While the princes of industry, who controlled the Congress that favored unions, gave them enough muscle to cause problems for middle class business owners, they were equally careful not to endow labor with enough power to impact them. As a result, when the Democratically-controlled 104th Congress enacted the North American Free Trade Agreement Bill Clinton rewarded the unions by letting them unionize the federal government. Without any legislated checks and balances to protect business—or the government—from the unions, what the unions lost in the private sector they easily gained in the public sector because government bureaucrats find it easy to negotiate with someone else's money.

Public sector workers earn a base wage of from 108% to 120% of what someone doing to same job in the private sector earned. As lucrative as the base wages for union workers are, unions find it is easier to negotiation future incomes than current income since the bureaucrats who make the deals that won't kick in for one, two or three decades are usually retired or dead when the city, county or State governments have to pony-up. By that time the union pension time bomb is someone else's problem. Add that problem to the subprime mortgage collapse, the collapse of Indonesia's Bank Century in 2007, losing 6.7 trillion rupah ($720 million) largely owed to US banks on the heels of the insolvency of Indonesia's central bank, Bank Indonesia, shortly after the passage of NAFTA when the third world began vying for US factories as the swinging import/export doors were being installed at the Gateway International Bridge between Brownsville, Texas and Matamoros, Tamaulpas in Mexico.

By 2005, a decade after the North American Free Trade Agreement was signed into law by Bill Clinton, several US banks were in trouble because, to keep the illusion alive that US still had a robust economy, the banks had to keep credit fluid. Since they knew they were overextending consumers, they also knew that somewhere down the pike very soon, the consumers would be paying the piper for their easy credit consumer spending spree. The banks needed to make sure they weren't left with the bill, so on April 20, 2005 Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act (Public Law 109-8, 119 Stat 23) which, of course, did not protect the consumers. It protected the banks by making sure consumers could not bankrupt themselves out of debt.

The batwing swinging doors in Brownsville continued to swing both ways. More factories and more jobs left the United States, detoured through Mexico on their way to China and Indonesia; and more Chinese and Mexican goods—made with American jobs in third world countries—returned, tariff-free, to the United States for US consumers to buy with all of the new credit cards the banks kept sending them.

Finally, the day of reckoning arrived. The princes of industry, greedily counting their money in new plush offices in Beijing, Jakarta, and Guadalajara, Mexico, cautiously continued the exporting of jobs. The wild card in their carefully calculated job transfers was Barack Obama, whose penchant for creating new FDR-type regulations to control the private sector would kick a massive hole in the bottom of what was then still a half-full, slowly dripping, jobs bucket in America.

Employers stopped hiring because regulations mean the cost of doing business was about to skyrocket in the United States. The moment Obamacare was enacted, frightened employers began looking at their employee pools for the most expendable workers whether or not they could keep their heads above water in the sea of unemployment. Most could not. Large and midsized employers did not hesitate to jettison workers. The layoffs began. Not only is consumer spending slowing, tax revenues are plummeting at an even faster rate. Barack Obama is not only his own worst enemy, he is America's worst enemy as well.

While the financial crisis

that began in late 2007 started with the collapse of the Bank of Indonesia,

it was the making of the princes of industry and the barons of banking

whose determination to harness the human capital of the third world caused

them to overextend themselves to such a degree that when the Bank of

Indonesia failed, it fractured the foundations of some of the world's

largest banks.  The

banks, by the way, which are owned by the America's richest families who

also own the Federal Reserve System. You know them as "the banks

that are too big to fail."

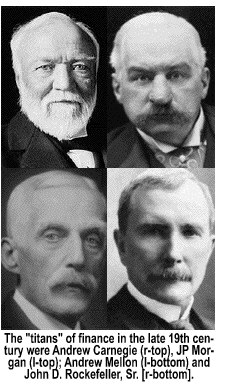

One of them is AIG, which was founded by John D. Rockefeller, Sr.,

Andrew Mellon, John Pierpont Morgan, Andrew Carnegie

and a host of other American bankers, industrialists, railroad tycoons

and a host of merchant princes. Two others were iconic investment banks

Bear Stearns and Lehman Brothers who bet too heavily on

the subprime market, and AIG who covered their bets while their own hedge

fund division in Europe sold the bottom out of the subprime stocks, which

led to a criminal investigation of AIG. Of course, no charges were ever

filed since banks too large to fail are too large to be charged with a

crime. In fact, the Treasury and the Fed were pouring unprecedented amounts

of money into AIG to keep it solvent. The Obama printing presses

have printed over $7 trillion since 2009. Much of that money was simply

placed into circulation, devaluating every dollar already in existence.

The

banks, by the way, which are owned by the America's richest families who

also own the Federal Reserve System. You know them as "the banks

that are too big to fail."

One of them is AIG, which was founded by John D. Rockefeller, Sr.,

Andrew Mellon, John Pierpont Morgan, Andrew Carnegie

and a host of other American bankers, industrialists, railroad tycoons

and a host of merchant princes. Two others were iconic investment banks

Bear Stearns and Lehman Brothers who bet too heavily on

the subprime market, and AIG who covered their bets while their own hedge

fund division in Europe sold the bottom out of the subprime stocks, which

led to a criminal investigation of AIG. Of course, no charges were ever

filed since banks too large to fail are too large to be charged with a

crime. In fact, the Treasury and the Fed were pouring unprecedented amounts

of money into AIG to keep it solvent. The Obama printing presses

have printed over $7 trillion since 2009. Much of that money was simply

placed into circulation, devaluating every dollar already in existence.

Now you know why prices for consumer goods—and gasoline—are skyrocketing. Economic commodities are pegged at their intrinsic value just as asset-backed debt (i.e., Federal Reserve notes) have a commodity value equal to the value of the collateral. When there is no collateral, the value not only of that money just printed, but all money in circulation, is devalued. Every American with a buck in his pocket has a dollar that's now worth about 50.3¢ in pre-Obama dollars based on the commodity value of gold from Dec. 31, 2008 to Sept. 4, 2012. And you wondered why it is that you can't afford to go to the supermarket anymore.

On Sept. 30, 2008 when a very nervous Bush-43 Treasury Secretary Henry Paulson proposed a $700 billion bank bailout, he submitted it on a hastily scribbled three page synopsis. Paulson's proposal offered nothing to the consumers who desperately needed help to save their homes. Paulson's plan would simply provide funds to buy mortgage-related assets from troubled banks. The foreclosed subprime properties would be purchased by the Resolution Trust Corporation who would sit on them until the crisis passed, or dispose of them to speculators who would then buy them as rental properties since the homeowners who lost the homes still needed places to live. Where better than in the homes they currently resided in? They would simply transition from being homeowners to tenants since, in Paulson's view, most of those homeowners should never have been given mortgages in the first place.

Congress rejected Paulson's proposed Troubled Asset Program for two reasons. First, because Paulson's plan contained no oversight provisions. And, second, while the Democrat majority had no problem with helping the bankers, who could be gracious campaign contributors, there was nothing in it for the voters—Main Street consumers. Congress decided this was the perfect tinker-toy bill, so they tinkered with it, adding several hundred pages. When they finished, they gave themselves broad oversight authority over the Treasury's disbursement of TARP funds in the form of a Special Inspector General of TARP (SIGTARP), and they added a virtually limitless expansion of the interpretation of what a "troubled asset" might be.

Helping the tinker toy project was Obama, working first with Paulson for two months, and then Geithner, to use TARP money to inject liquidity directly into the banks that were "too big to fail." After initially rejecting it, Congress approved TARP and Bush-43 signed it into law on June 30, 2008, authorizing the Treasury to purchase $350 billion of "troubled assets" to free up credit for consumers. The troubled assets the Treasury invested in weren't the toxic mortgages the banks "too big to fail" were holding. They invested in the banks themselves, by shoring up their assets. Paulson told Barofsky that even before TARP made it through Congress he thought about using the CPP (Capital Purchase Program) with TARP funds to buy preferred bank stock. He told Barofsky that he felt Morgan Stanley was within days of collapse. Bernanke, he said, believed that Goldman Sachs would follow Morgan Stanley down the tubes. After that, Paulson said, all bets on the country's financial system would be off. The domino affect would have started.

Four weeks before the Election of 2008, TARP was signed into law by Bush-43. Eleven days later Paulson, Bernanke and Timothy Geithner, the head of the New York Fed, put Paulson's plan into action. The first part of TARP was supposed to provide $350 billion to shore up the liquidity of banks by buying their toxic assets. That didn't happen. The toxic assets remained in the inventories of the nation's banks with the Fed deliberately increasing the toxicity of those assets by forcing every bank in the nation to reduce the value not only of the foreclosed toxic assets by every mortgage on their books based on actual market value of those homes a year into the subprime crisis. What does that mean?

It means that the Fed's decision to reappraise the value of the banks collateral assets had a tsunami-like impact on banks which were solvent five minutes before the Fed devalued their mortgage loan assets, were suddenly no longer solvent and, according to the Fed bankers, at risk of imminent financial collapse. It was the same tactic bankers used in the Bank Panic of 1906 and during the Stock Market Crash of 1929 to buy-up smaller banks with strong asset bases who were insolvent only on paper based on regulations imposed by government in 1906, and by the Federal Reserve (a privately-owned central banks which the US government has no legal power to control from 1913) in 2008.

CPP was a bank bailout, plain and simple. Not a bailout of homeowners on Main Street, but of banks on Wall Street. On Oct. 12, 2008, Paulson, Geithner (Obama's pick for Paulson's job almost a month before the Election) and Bernanke took $125 billion of the $350 billion allocated for TARP by Congress, and loaned it to nine of the largest banks in the country. It was cheap money according to Citigroup CEO Vikram Pandit and Jamie Dumon, head of JP Morgan Chase. Barofsky noted that the Congressional Oversight Committee said it was "...too generous by 22%." Members of Congress on both sides of the aisle began voicing objections to the Treasury Secretary's broad interpretation of using TARP funds for CPP since it was not their intention when they enacted the Housing and Economic Act of 2008 (HR 322) (Public Law 11-289, 122 Stat. 2654), followed by the Emergency Economic Stabilization Act of 2008 (Public Law 110-343, 122 Stat 3765) to buy back mortgage-backed securities.

Congressman Barney Frank [D-MA], head of the Financial Services Committee in 2008, was furious because instead of using the funds to purchase toxic assets from the banks in order to stimulate lending, Paulson used a sleight of hand maneuver to simply give the money to the banks—with no strings attached. Frank demanded to know by what authority Paulson was funneling TARP funds into CPP. Paulson answered him with a public press release stating the purpose of TARP was to stimulate lending. What he did was "To enhance the ability of he recipient banks to perform their vital function of lending, and..." (what he did) "...was intended to get credit flowing."

In reality, what Paulson did—and Geithner did three months later—provided the banks (which were deemed to be too big to fail) with cash to buy up the smaller banks that the Fed declared to be insolvent because they no longer had the cash reserves needed to cover the shortfalls created by the Fed's decree that they reappraise the mortgage collateral they were holding based on the current greatly diminished street value of the collateralized real estate in their inventory after the bottom fell out of the real estate market in the United States.

When Obama arrived at 1600 Pennsylvania Avenue someone on the other end of Pennsylvania Avenue apparently forgot to tell him they had already enacted a bill to save the economy by using $350 billion of the $700 billion TARP act to buy up toxic mortgages, get them out of the banks' inventory, and free up credit in the United States. Then they were supposed to use the other $350 billion of TARP to modify the mortgages on homes no longer worth what the owners paid for them due to the Fed's devaluation. But,. since the Fed and Treasury diverted the money that was supposed to bailout Main Street (which the Fed apparently believed was not too big to fail) to bailout Wall Street, Obama needed to do a make good. The make good was called the American Recovery and Reinvestment Act. Buried in that piece of legislation was the Obama Death Board.

Believe it or not, as far as the consumer dilemma and the dilemma of the Main Street America small commercial banks where we keep our checking and savings accounts, it was that simple. What complicated the dilemma was that the mega-banks which were too large to fail were failing. Or, rather, they had already failed. They could no longer pay their own debts. Those banks included the newly chartered American Express Bank, American International Group [AIG], Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Mellon Bank (Bank of New York), Morgan Stanley, and Wells Fargo.

The United States of America slipped into what can only be described as a "1933 morass" in 2009, caused by an artificial intelligence in the White House who spent his days studying the political history of the 20th century. Obama attempting to splice slices of the 1932-37 historic narrative into the narrative of 2008-12 to achieve what he hoped would be the identical outcome accomplished by his presidential predecessor. Obama (and anyone who understands basic economics) knows that the post-Stock Market Crash economy, like the economies of all of the European industrial nations, was rapidly rebounding by the early fall of 1932. The Democrats, who gained an electoral lock on the House and Senate in 1930 were already taking their marching orders from New York Gov. Franklin D. Roosevelt, the presumptive Democratic nominee for 1932—two years down the road. (In 2009, when Barack Obama addressed the National Association for the Advancement of Colored People [NAACP], he spoke not like a candidate seeking the nomination of his party, but as one who had already been nominated—and elected. Like FDR who was backed by every bank in the United States that was "too big to fail," so was Obama on the day of the 2008 New Hampshire Primary. The day before the primary, those banks: JPMorgan Chase, Goldman Sachs, Citigroup, Morgan Stanley, Lehman Brothers and the Mellon Bank were solidly committed to Hillary Clinton.)

On Jan. 8, 2008 as Hillary Clinton was soundly drubbing Barack Obama in New Hampshire—and she was poised to win that primary with 39.4% of the vote to Obama's 36.8%—an elated Hillary Clinton appeared suddenly crushed when one of her lieutenants whispered in her ear. At that precise moment as she was winning that primary, the banks "too big to fail" had just pulled their campaign donations from her account and gave the money to Obama. In lesser amounts, those same banks that are "too big to fail" also financed Sen. John McCain's losing campaign. Now you understand why some banks are "too big to fail." When you own the politicians who oversee the dole, you can't fail.

Under the Housing and Economic Act of 2008 Uncle Sam was obligated to buy all of the foreclosed subprime mortgages, remove them from the banks' bad debt inventories; and with an influx of new money, restore liquidity to the banks and mortgage companies in order to jumpstart credit buying by consumers and slowly, regrow a devastated economy. Sounds simple. And, initially, it should have been. The Bush-43 Administration's Housing and Economic Act of 2008 would have accomplished that objective—if a rogue US Treasury and a rogue Federal Reserve had not changed the game plan in order to save Wall Street instead of Main Street. Now, Bush-43's economic slowdown of 2005 evolved into Obama's Recession once he began tinkering with the banks like Roosevelt did in 1933. FDR blamed his tinkering on Herbert Hoover. If someone who knows how to manage an economy does not take the reins quickly, what's happening now is going to become Obama's Depression.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.