News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

ive

years have passed and the tax resistance groups still don't get it. The

16th Amendment was fraudulently certified as ratified by William Howard

Taft's Secretary of State Philander Knox on Feb. 13, 1913.

Notwithstanding, the federal income tax is here to stay. A cloud of suspicion

still hangs over the 16th Amendment because scores of constitutional errors

that invalidate the resolutions have not been legally resolved—or

even discussed in a public forum by the federal government as guaranteed

by the 1st Amendment.

ive

years have passed and the tax resistance groups still don't get it. The

16th Amendment was fraudulently certified as ratified by William Howard

Taft's Secretary of State Philander Knox on Feb. 13, 1913.

Notwithstanding, the federal income tax is here to stay. A cloud of suspicion

still hangs over the 16th Amendment because scores of constitutional errors

that invalidate the resolutions have not been legally resolved—or

even discussed in a public forum by the federal government as guaranteed

by the 1st Amendment.

The resolutions

of all but six States were flawed in some manner and should not have been

certified by Knox. That was the reason Taft's Solicitor

General, Joshua Reuben Clark, Jr. stepped into the equation to

settle the "legal issue."  On

ratification resolution matters, the job of the Secretary of State is

simply to count the ballots and determine if enough States voted "yes"

to ratify the amendment. Nothing more. Nothing less.

On

ratification resolution matters, the job of the Secretary of State is

simply to count the ballots and determine if enough States voted "yes"

to ratify the amendment. Nothing more. Nothing less.

Thirty-six States needed to say "aye" for the 16th Amendment to become law. Knox and Clark claimed 36 States—the precise number the government needed—ratified it. The last State to do so, according to Senate Document 240, was West Virginia. However, on April 13, 1913—upon receipt of a letter from President Woodrow Wilson's Secretary of State, William Jennings Bryan, asking those States who failed to ratify the 16th Amendment to do so for the sake of "national unity"—one of West Virginia's US Senators responded, saying "...As this amendment has already been ratified by 36 States...this paper can now serve no useful purpose. I had always supposed that West Virginia had been in time to get in the official count. Her intentions were good, I know."

Attached to the letter was the affirmative vote of the West Virginia legislature which passed the 16th Amendment "for unity" after receiving Bryan's letter. Little did that State's legislators know that West Virginia, which had not voted on the 16th Amendment prior to that date, was counted as the 36th and final vote needed to make the 16th Amendment the law of the land—two months before the West Virginia legislature actually voted on the matter.

Suspicion of criminal wrongdoing by Clark and Knox—which the federal courts have steadfastly refused to acknowledge or consider—is solely responsible for the birth of the anti-tax movement in the United States. Had easily proven fraud not existed in the ratification of the 16th and 17th Amendments, the anti-tax movement would not exist today.

Knox, realizing that the States had deliberately made errors in the wording of the amendment or invalidated their resolutions by other means, knew he could not legally declare them ratified. He turned to Clark for an answer. Like Knox, Clark lacked the authority to render judicial "decisions." He was a lawyer, not a judge. Clark should have referred the question to the US Supreme Court. He chose not to. Clark decided that the multiplicity of errors in the ratification certifications didn't nullify the resolutions, arguing that if the States didn't want to ratify the amendment, they would have simply not amended it. In his official statement, Clark began: "It is submitted...that this does not in any way invalidate the action of the legislature or nullify the effect of the resolution[s], as it is believed that the approval..." As he casually dismissed the multitude of errors found in most States' flawed resolutions, Clark assumed judicial authority he did not possess while taking care to note that he was merely offering an unofficial opinion. "It is submitted..." and "...it is believed" merely advance a legal opinion, not a binding conclusion. Clark decided that since the States obviously intended to ratify the amendment, the errors that legally rendered their resolutions invalid should be ignored—and the "spirit of their intention" counted instead. No one challenged Clark's opinion until 1983. By that time, it was too late. The federal income tax was codified. Through precedent, the federal income tax became the irrevocable law of the land. Even if the 16th Amendment is somehow toppled in court, the income tax will remain since the federal judiciary has decided that, the 16th Amendment notwithstanding, Congress possessed the right to legislate an income tax evidenced by Lincoln's unchallenged income tax in 1862.

An ad hoc group called the Montana Historians was formed in April, 1980 by Montana businessman and former State legislator, M. J. "Red" Beckman after he uncovered evidence that fraud had been committed by that State in certifying its ratification of the 16th Amendment. Much of Beckman's knowledge came from the early research on the subject done by Sam Bitz, a documentary historian, who had been accummulating data on the questionable ratification of both the 16th and 17th Amendment for several years. Unlike Beckman, Bitz has never been part of the antitax movment.

In March, 1983 Beckman was called as an expert witness in the Fort Worth, Texas income tax evasion trial of Allen Lee Buchta. Armed with over 400 documents from the archives of most of the States Beckman had enough evidence to raise a valid argument about the legality of the ratification.

US District Court Judge James T. Moody ruled the evidence was inadmissible—and seized all of the documents which, to date, the court has never released. Moody ruled that because none of the documents were notarized, and because Beckman had no affidavits from State officials affirming that the copies were of the originals in the State archives, they were invalid. Further, Moody said, even if the defendant's witness had that information it was a political, not a judicial, dilemma and that it was up to Congress, not the courts, to fix the problem. Buchta was convicted.

At the conclusion of the trial, Beckman teamed up with the paralegal employed by Andrew Spiegel, Buchta's lawyer. The anti-tax movement had just grown legs. Financed by Beckman and Connecticut businessman George Sitka, Bill Benson traveled to every State and collected over 17 thousand documents that suggested fraud, in some form, in the ratification of both the 16th and 17th Amendments by almost every State—and evidence of the Taft and Wilson Administration's efforts to whitewash the fraud.

While the courts have blamed Congress and Congress has blamed the courts, the Constitution is clear where the jurisdiction lies. It lies with the Supreme Court. That means the high court cannot, in good conscience, decline to consider the evidence. After examining the archive documents presented attorney Lowell Becraft during the income tax evasion trial of George and Marion House in June, 1983, Assistant US Attorney David Brown admitted that Secretary of State Philander Knox had committed a crime in certifying the 16th Amendment as lawfully ratified, but argued that the government accepted the ratification "on good faith," so that "...a 72-year old fraud on the part of a long dead Secretary of State [is] inconsequential, and the government [is not] obligated to create a red herring by investigating it."

The Birth Of the Patriot Movement

The failure of either the federal judiciary or the US Congress to address the legality of the federal income tax in light of the evidence uncovered by the ad hoc group gave legs to the Christian resistance movement that began as a separation of church and State battle in the basement of Rev. Everett Sileven's Faith Baptist Church in Louisville, Nebraska in August, 1977.

Faith Baptist opened an uncertified Christian school in the basement of the church. In Nebraska, State law then required that even private school teachers be certified by the State. The teachers at Faith Baptist were not. A local judge issued an injunction and closed the school, starting a long legal battle that would give birth the Christian resistance movement. Maintaining the church's right to operate a Christian school with lay teachers who were not certified by the State, Sileven insisted that "...this school represents our right to exercise our religion," adding that "...the State [was] in violation of God's law." Sileven violated the injunction so many times that the judge finally ordered the church padlocked. The padlocks were removed only on Sundays and Wednesday evening so the congregation could have services. Twice between 1981 and 1983 the court removed the padlocks. Both times, Sileven started classes again. And, both times, Sileven was jailed for contempt of court. Both times, one of the high profile supporters who came to Faith Baptist Temple in Louisville, Nebraska was Gregory J. Dixon, senior pastor of Indianapolis Baptist Temple and the national secretary of Jerry Falwell's Moral Majority. Dixon formed the Coalition for Religious Freedom after being asked by Jerry Falwell to resign from the Moral Majority. When Sileven was jailed for the second time, 450 pastors—led by Dixon—showed up in Louisville and occupied the church until Sileven was released from jail.

In 1984 Sileven finally won his battle against the city of Louisville. A panel of federal judges ruled that the local judge overstepped his authority and that the local sheriff acted unconstitutionally arresting members of the congregation in the October, 1982 raid on the church.

A governor's panel determined that the State statute requiring the certification of private school teachers was likely unconstitutional and vacated the law. Sileven's victory spawned the Christian resistance movement—and also added fodder to the anti-tax movement that was aggravated by Christian extremists like Pete Peters of Christian Identity, former Klansman Louis Beam and Aryan Nations leader Richard Butler. Peters fathered the militia movement. In one of his speeches, Peters argued that every church in America should have its own militia.

The Birth Of the Anti-tax Movement

As Dixon listened to Sileven—who as a high school senior opposed the senior prom because he believed dancing inspired lustful thoughts—and other Christian separatists, he began to see the Church as the nation's safe haven against the overreaching intrusiveness of government. Indianapolis Baptist Temple, like most churches in America was a 501[c]3 tax exempt charity under IRS regulations.

Most Americans believe churches possess an inherent constitutional exemption from being taxed. There is absolutely no provisions in the Constitution—particularly in the 1st Amendment—that absolves religious institutions from paying taxes. Those exemptions were granted by federal legislators who opted to waive taxes on the tithes of churches based solely on the Biblical perspective of "render unto Caesar that which is Caesar, and render unto God that which is God's." Recognizing that tithes are "rendered unto God," Congress wisely exempted the tithes of churches from taxation—providing the church filed the necessary tax exempt paperwork as a 501[c]3 charity.

The

argument that the income tax is illegal because the 16th Amendment was

fraudulently ratified is valid. However, US law, backed by the Constitution,

does not give any citizen or group of citizens the right to arbitrarily

disobey laws—even those they believe were wrongfully or fraudulently

enacted. The people have the right to challenge them in a court of law.

Conversely, the Constitution of the United States does not give government

the right to capriciously ignore the people when they demand the right

to address their grievances with that government. In doing so, the government

assumes for itself powers it does not possess. This is the issues that

gave birth to the patriot movement in the United States.

The

argument that the income tax is illegal because the 16th Amendment was

fraudulently ratified is valid. However, US law, backed by the Constitution,

does not give any citizen or group of citizens the right to arbitrarily

disobey laws—even those they believe were wrongfully or fraudulently

enacted. The people have the right to challenge them in a court of law.

Conversely, the Constitution of the United States does not give government

the right to capriciously ignore the people when they demand the right

to address their grievances with that government. In doing so, the government

assumes for itself powers it does not possess. This is the issues that

gave birth to the patriot movement in the United States.

With respect to freedom of religion, what the 1st Amendment was supposed to do was protect was the right of American citizens to worship God in the manner they chose—without interference from the government. Further, it forbids the government from mandating a State-approved religion. (Far left legal advocacy groups aided by activist judges have violated the 1st Amendment by restricting the religious rights of Christian Americans to the direct benefit of anti-Christian and anti-patriotic groups opposed to Christianity and in favor of world government. Egregious rulings by far left socialist activist judges that actually violate the 1st Amendment while purporting to protect religious freedom added dry kindling to the fires of discontent and placed far right Churches squarely in the center of the controversy.)

Indianapolis Baptist Temple pastor Gregory J. Dixon—who once claimed that slavery saved the black race from going to Hell—was greatly influenced by the antigovernment patriot movement that used Christianity as a weapon. Dixon argued that religion should have nothing to do with "the state." After his 16-year battle with the IRS, Dixon grew to believe that the Christian community in the American society was a nation of brethren within a hostile nation and that government was the natural enemy of man. As Dixon's antigovernment sentiments increased, he formed the American Coalition of Unregistered Churches. In 1986, he unincorporated IBT and stopped withholding income tax, FICA, Medicare and both State and federal unemployment taxes from the wages of church employees. From that date forward, IBT deducted no taxes from its employees, paid no applicable Social Security taxes, nor did the church paid unemployment taxes. Scores of small fundamentalist Christian churches followed suit and joined Dixon's organization. This network merged with the structured framework of what became known as the patriot movement.

The IRS closes in on IBT

In 1994, the Clinton IRS tried to contact IBT about its failure to file income tax returns since 1987. The IRS constructed income records as best it could from IBT's 501[c]3 history and prepared tax filings for IBT for tax years 1987 to 1993. While IBT renounced its 501[c]3 status, the IRS formally revoked its status as a tax exempt entity on May 8, 1995. Two months later, on July 7, the Indiania Dept. of Revenue did the same thing. The IRS filed tax liens totaling $3.6 million against IBT. Dixon then appears to have replaced ACUC with another unincorporated entity called the Unregistered Baptist Fellowship, thinking, it appears, that in doing so he was somehow sidestepping the Internal Revenue Service. The sum in the federal lien represented not only the withholding taxes (i.e., income tax, Social Security and Medicare) that employers are required by federal law to withhold from the wages of their employees, but also the income taxes owed on the estimated "earnings" of IBT—which had renounced its own 501[c]3 standing in 1986—and accrued interest and penalties on those taxes, real and estimated, between 1987 and 1994. The IRS also filed liens of $31,052.00 against Dixon.

In March, 1950 the Indianapolis Baptist Temple was incorporated as a 501[c]3, not-for-profit corporation—as most churches are. Five years later, a 23-year old, not quite dry-by-the-ears Rev. Gregory J. Dixon became pastor of IBT. During the next two decades, IBT grew by about 300 members a year, reaching its peak in 1970 when IBT had over 8,000 members and was one of the largest churches in the nation. As radicalism found its way into Dixon's pulpit, his congregation began thinning out. In the mid-1980s. Dixon formed what the media referred to as the "Court of Divine Justice" which openly prayed not only for the death of totalitarian world leaders who opposed Christianity, but public officials in the United States who opposed the militia movement. By the late 1990s, the IBT congregation had dwindled to around 2,500 to 3,000.

In 1996, the IRS seized 20 acres of land near the Geist Reservoir, northeast of Indianapolis, that was owned by IBT. In a tax sale, the IRS auctioned it off to Traverse, Inc. for $172 thousand. Proceeds from the sale were applied to IBT's growing tax bill. At that point, it would seem to the logical mind that Dixon would have hired a good tax lawyer to reconcile his differences with the IRS and argue his position before a federal magistrate. Because of the Supreme Court legislated "separation of Church and State." Dixon stubbornly insisted that the government had no authority to tax either his church or its employees—all of whom he described as "ministers"—wrongly believing he was somehow exempting them from the obligation of paying taxes since all personal incomes—even those of employees of 501[c]3 organizations—are taxed under US tax code.

To most of Dixon's employees—who were also members of his congregation—this was not a battle they wanted to fight since most of them did not embrace the argument that the income tax was illegal—or, at least, they knew as long as there were federal and State laws on the books mandating that people pay those taxes, they were obligated to pay them until such time that the federal and State legislatures repealed those laws. Without exception, all of them filed, and paid, their federal and State taxes each year. Because IBT refused to provide them with W-2 earnings statements, all of them filed as self-employed wage earners. However, the Clinton Administration determined that the taxpayers had improperly filed as self-employed persons when they were actually "employees" of IBT. The IRS declined, or refunded, the taxes paid IBT's employees and sent the tax bill—with penalties and interest—to Dixon.

On

April 12, 1998 the IRS sued IBT, Dixon, and the church's bank in

the courtroom of US District Court Judge Sarah Evans Barker. The

new suit demanded payment of what had grown into a $5.1 million tax debt,

with penalties and interest. On June 29, 1999 Barker ruled against Dixon and IBT, granting judgment for $5.3 million. The IRS demanded

immediate relief—the seizure of all properties and assets, including

bank accounts, owned by the Indianapolis Baptist Temple. Suddenly Dixon and the church elders took the threat seriously. IBT appealed Barker's

decision to the 7th US Circuit Court of Appeals which heard oral arguments

on May 11, 2000. The appellate court also ruled against IBT on August

14, 2000.

On

April 12, 1998 the IRS sued IBT, Dixon, and the church's bank in

the courtroom of US District Court Judge Sarah Evans Barker. The

new suit demanded payment of what had grown into a $5.1 million tax debt,

with penalties and interest. On June 29, 1999 Barker ruled against Dixon and IBT, granting judgment for $5.3 million. The IRS demanded

immediate relief—the seizure of all properties and assets, including

bank accounts, owned by the Indianapolis Baptist Temple. Suddenly Dixon and the church elders took the threat seriously. IBT appealed Barker's

decision to the 7th US Circuit Court of Appeals which heard oral arguments

on May 11, 2000. The appellate court also ruled against IBT on August

14, 2000.

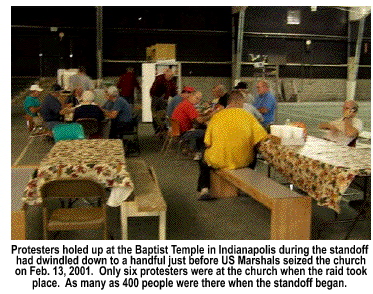

On Sept. 6, Barker gave IBT ten days to show why the government should not be granted the right to foreclose on the church's assets. The deadline passed without any action taken by the IRS until Sept. 29 when Barker issued an order for Dixon to vacate the property and surrender it to the IRS for a tax auction sale on or before Nov. 14. While both sides wanted to end the confrontation without violence, the Clinton Administration had the most at stake since Vice President Al Gore, Jr. was running against Texas governor George W. Bush for the presidency, and they could not afford another Waco or Ruby Ridge some 60 days before the voters cast their ballots for the 43rd President of the United States. Dixon, on the other hand, hoped to find a peaceful solution that would allow his family to retain his church building. On Nov. 7, 2000, US Supreme Court Justice John Paul Stevens turned down a request from Dixon's lawyers to delay enforcement of the order to vacate.

On Nov. 14—a week after America elected its 43rd president and 29 days before America would learn who it was—more than 600 patriot supporters and church members gathered at the Indianapolis Bible Temple to await the US Marshals. Only none showed up. Waco still left a sour taste in Bill Clinton's throat. And, even though Attorney General Janet Reno took the hit for Waco, the tragedy in which 76 Branch Davidians died on April 19, 1993 actually hatched in the fertile mind of Hillary Rodham Clinton. Bill Clinton decided to let his successor—whether Bush or Gore—handle the mess at the Indianapolis Baptist Temple. The stalemate continued. On January 16, 2001, four days before George W. Bush was sworn in as the 43rd President of the United States, the Supreme Court declined to hear the Baptist Temple case, ending Dixon's legal options. It was now a case of pay up or get out.

The first task that fell on the shoulders of incoming Attorney General John Ashcroft—an Assembly of God Pentecostal Christian—was the tax confiscation of IBT. Ashcroft knew that the IBT employees paid their own taxes on what IBT called "love offerings" rather than wages. However, he did not seem to be aware that the IRS declined to accept the tax filings of church employees and refunded the taxes they paid in order to tack those amounts on the moneys owed by IBT and pastor Greg J. Dixon.

Dixon exacerbated the standoff by telling the media that he would never walk

out of the church under his own power, throwing down the gauntlet to the

government to remove him by force. Ashcroft pondered Reno's

Waco dilemma and realized the Justice Department was facing another "no-win

situation" that held the potential of being even more embarrassing

than Waco because the congregation at IBT were not a fringe cult group,

but members of a mainline Christian denomination.  Ashcroft sent FBI Director Robert Meuller, then a deputy attorney general,

to Indianapolis to talk with the people on the ground before the US Marshals

moved on the church.

Ashcroft sent FBI Director Robert Meuller, then a deputy attorney general,

to Indianapolis to talk with the people on the ground before the US Marshals

moved on the church.

The night before the planned storming of the church, Ashcroft received a call from the White House that Bush wanted to send his own negotiator to speak with the church leaders. Ashcroft told the president that was a bad idea for a couple of reasons. First, the media was not paying too much attention to the IBT brouhaha. The last thing Ashcroft wanted was focused media attention which would only serve to harden the resolve of the those holed up in the church. Second, the dwindling number of people inside the church seemed to have lost most of their enthusiasm for a confrontational standoff. The government was monitoring the number of people in the church and planned to move when that number was at its lowest. Mueller learned that there was usually only from a half dozen to a dozen people in the church at any given time now—down from as many as 250 church members and up to 400 or more militia members who were sequestered there when the standoff began.

Likely remembering everything that went wrong at Waco, Bush told Ashcroft to go ahead with the understanding that if anything went wrong, it would be his head. The following morning, Feb. 13, 2001, fully armed US Marshals arrived at the church at 8:40 a.m. Only six people were guarding the church property. They were quickly rounded up without single a shot fired. The lone holdout was Pastor Greg J. Dixon who told the marshals he would leave the church standing up. "I promised God, my people and everybody else that I would not walk out of this church under my own power." Mueller, who was monitoring the seizure from his office in the Justice Department in Washington proposed that the marshals bring in a gurney and strap Dixon to it. That way, he would save face not only with his congregation but with the patriot groups who would treat him as a martyr on every broadband patriot radio talk show in the country for months to come.

The fallacies of the antitax arguments

While the mainstream

media barely mentioned the tax seizure of IBT on Feb. 13, patriot groups

and the Christian conservative talking heads on broadband radio fanned

the tax fires, postulating a broad range of anti-tax arguments.  While

I agree with the patriot groups that the confiscation of Indianapolis

Baptist Temple—or any church, mosque or synagogue—by the federal

government should never have happened, our reasons would differ. In the

final analysis, the IBT standoff happened because [1] Senior Pastor Gregory

J. Dixon was allowed himself to be persuaded that the 1st Amendment

prevented the government from exercising any jurisdiction over churches—even

to taxing the people who were employed by them; [2] because Dixon was convinced that there are no laws that obligate resident citizens to

pay the federal income tax since compliance, he believed, was voluntary. Dixon believed that the "free exercise" clause of the

1st Amendment absolved it from any liability to pay taxes. In reality,

the "free exercise" clause has nothing to do with taxes. The

"free exercise" clause guarantees all US citizens the inherent

right to worship God in whatever manner they choose—without interference

from government. Dixon argued before the 7th US Circuit Court of

Appeals that it would have been a literal sin against God for IBT to pay

taxes.

While

I agree with the patriot groups that the confiscation of Indianapolis

Baptist Temple—or any church, mosque or synagogue—by the federal

government should never have happened, our reasons would differ. In the

final analysis, the IBT standoff happened because [1] Senior Pastor Gregory

J. Dixon was allowed himself to be persuaded that the 1st Amendment

prevented the government from exercising any jurisdiction over churches—even

to taxing the people who were employed by them; [2] because Dixon was convinced that there are no laws that obligate resident citizens to

pay the federal income tax since compliance, he believed, was voluntary. Dixon believed that the "free exercise" clause of the

1st Amendment absolved it from any liability to pay taxes. In reality,

the "free exercise" clause has nothing to do with taxes. The

"free exercise" clause guarantees all US citizens the inherent

right to worship God in whatever manner they choose—without interference

from government. Dixon argued before the 7th US Circuit Court of

Appeals that it would have been a literal sin against God for IBT to pay

taxes.

And, finally, [3] in protest, IBT willingly relinquished its tax exempt status as a church/charity, thus creating its own tax liabilities as a for-profit business enterprise called the Indianapolis Baptist Temple. There is no tax exempt status in the tax code known as "unregistered churches." Dixon's lawyers argued before the 7th Circuit that IBT relinquished its 501[c]3 standing and became an unincorporated religious society when it redefined itself as a "New Testament Church." That decision was based on Dixon's personal belief—and not any sound legal advise from a competent tax attorney—that because Jesus Christ was the sovereign head of the New Testament Church, IBT could legally reject secular government authority. It was at this point a government report notes, Dixon stopped filing federal employee tax returns and paying federal employment taxes.

There are a myriad of reasons why anti-tax advocates claim the government cannot require you to pay federal income taxies. The reasons are as varied as the seminars offered—for a fee—by the anti-tax advocacy groups themselves. None of the arguments are valid since all of them have been tried, tested—and failed in the courts were tax seizures are affirmed. Each begins with the same basic truth: the 16th Amendment was fraudulently declared ratified in 1913 because the bankers who were creating the Federal Reserve System needed to bind the taxpayers to the debt they would be forced to pay. That is a fact. But it's the only fact in the argument advanced by the anti-tax crowd. Among the arguments advanced by the anti-tax crowd that American citizens not required to pay taxes are statements like:

![]() The

instructions in the 1040 tell us the federal income tax is a voluntary

tax. That means you have a choice whether or not you wish to pay it. In reality, what the IRS says is that American tax law allows the taxpayer

to determine how much he or she owes by preparing their own tax forms

rather than have the government arbitrarily assess a tax each year. Thus,

paying taxes is not voluntary—as those who choose not to file and

refuse to pay ultimately discover. Once the IRS determines that a taxpayer

has decided to no longer pay taxes, and declines to file a return (or

files a "zero" return), the government flags the account and

lets the wayward taxpayer build their own financial coffin—just as

it did with the Indianapolis Baptist Temple. If you fail to file your

taxes for one year and get caught, the worst that will happen is that

you will discover that paying taxes is not voluntary. The IRS will not

knock on your door for about five years. When they do, you will discover

fines, penalties and interest will grow your tax liability three, four

or fivefold. Most tax resisters simply stop paying completely as a form

of civil protest. The IRS will generally sit on the file for five to seven

years before going after them. At that time, the IRS will file criminal

charges that carry stiff prison sentences in addition to allowing the

government to place a lien on, and seize, every tangible asset owned by

the tax resister—once again proving that paying taxes is not optional. ((United States v Gerads, 999 F.2d 1255, 1256 [8th Cir, 1993]; United

States v Tedder, 787F.2d 540, 542 [10th Cir, 1986]; United States v Bressler,

772 F.2d 287, 291 [7th Cir, 1985]).

The

instructions in the 1040 tell us the federal income tax is a voluntary

tax. That means you have a choice whether or not you wish to pay it. In reality, what the IRS says is that American tax law allows the taxpayer

to determine how much he or she owes by preparing their own tax forms

rather than have the government arbitrarily assess a tax each year. Thus,

paying taxes is not voluntary—as those who choose not to file and

refuse to pay ultimately discover. Once the IRS determines that a taxpayer

has decided to no longer pay taxes, and declines to file a return (or

files a "zero" return), the government flags the account and

lets the wayward taxpayer build their own financial coffin—just as

it did with the Indianapolis Baptist Temple. If you fail to file your

taxes for one year and get caught, the worst that will happen is that

you will discover that paying taxes is not voluntary. The IRS will not

knock on your door for about five years. When they do, you will discover

fines, penalties and interest will grow your tax liability three, four

or fivefold. Most tax resisters simply stop paying completely as a form

of civil protest. The IRS will generally sit on the file for five to seven

years before going after them. At that time, the IRS will file criminal

charges that carry stiff prison sentences in addition to allowing the

government to place a lien on, and seize, every tangible asset owned by

the tax resister—once again proving that paying taxes is not optional. ((United States v Gerads, 999 F.2d 1255, 1256 [8th Cir, 1993]; United

States v Tedder, 787F.2d 540, 542 [10th Cir, 1986]; United States v Bressler,

772 F.2d 287, 291 [7th Cir, 1985]).

![]() Wages,

tips, etc. received as compensation for personal services are not income.

Anti-tax advocates argue that the 16th Amendment does not specifically

authorize a tax on wages and income but only on the "gains"

and "profits" of that income. There are two problems with this

argument. First, the 16th Amendment is not tax law. The questionable legality

of the amendment notwithstanding, the 16th Amendment is merely the consent

of the people, through their States, to be taxed in that form. Second,

the text of the amendment belies the argument that the amendment does

not permit a tax on incomes since the 16th Amendment says: "The

Congress shall have the power to lay and collect taxes on incomes, from

whatever source derived, without apportionment among the several State,

and without regard to any census or enumeration."

Wages,

tips, etc. received as compensation for personal services are not income.

Anti-tax advocates argue that the 16th Amendment does not specifically

authorize a tax on wages and income but only on the "gains"

and "profits" of that income. There are two problems with this

argument. First, the 16th Amendment is not tax law. The questionable legality

of the amendment notwithstanding, the 16th Amendment is merely the consent

of the people, through their States, to be taxed in that form. Second,

the text of the amendment belies the argument that the amendment does

not permit a tax on incomes since the 16th Amendment says: "The

Congress shall have the power to lay and collect taxes on incomes, from

whatever source derived, without apportionment among the several State,

and without regard to any census or enumeration."

![]() Only

foreign-sourced incomes are taxable. Anti-tax advocates maintain that

federal income taxes are excise taxes that can legally be imposed only

on nonresident aliens and/or foreign corporations who derive income from

within the United States. The premise for this argument comes from

misreading Sections 861 et seq. and 911 et seq. of the tax code (and the

relevant regulations under those sections) and misunderstanding what those

sections actually say. Sections 861 and 911 merely define the sources

of income (US vs non-US) to prevent the risk of double taxation on money

that is subject to taxation in more than one country. (Great Western

Life Assurance Co. v United States, 678F.2d 180, 183)

Only

foreign-sourced incomes are taxable. Anti-tax advocates maintain that

federal income taxes are excise taxes that can legally be imposed only

on nonresident aliens and/or foreign corporations who derive income from

within the United States. The premise for this argument comes from

misreading Sections 861 et seq. and 911 et seq. of the tax code (and the

relevant regulations under those sections) and misunderstanding what those

sections actually say. Sections 861 and 911 merely define the sources

of income (US vs non-US) to prevent the risk of double taxation on money

that is subject to taxation in more than one country. (Great Western

Life Assurance Co. v United States, 678F.2d 180, 183)

![]() Taxpayers

can refuse to pay income taxes on religious or moral grounds by invoking

the 1st Amendment. That, of course, was the argument of IBT and we've

seen how well that worked. (United States v Indianapolis Baptist Temple,

224F.3d 617, 629-631 [7th Cir 2000], cert denied 531 US 1112 [2001]).

Refusing to pay on religious grounds is the most common form of tax protest,

followed by people who protest how the government spends their tax dollars.

Relevant tax law debunks every argument for not paying.

Taxpayers

can refuse to pay income taxes on religious or moral grounds by invoking

the 1st Amendment. That, of course, was the argument of IBT and we've

seen how well that worked. (United States v Indianapolis Baptist Temple,

224F.3d 617, 629-631 [7th Cir 2000], cert denied 531 US 1112 [2001]).

Refusing to pay on religious grounds is the most common form of tax protest,

followed by people who protest how the government spends their tax dollars.

Relevant tax law debunks every argument for not paying.

![]() Some of the

other arguments for not paying federal taxes are: taxpayers are not

"persons" as defined by the IRS and, therefore, are not subject

to taxes. (United States v Karlin 785 F.2d 90, 91 [3d Cir, 1986]) • The IRS must file an income tax return for any taxpayer

who does not file. This relieves the citizen of the "burden,"

of filing, and relieves them of the obligation to pay if the IRS does

not file on their behalf. Section 6020[b], which is cited, merely

provides the IRS with the mechanism to determine tax liability on those

who do not file. The liability includes the taxes that would be paid if

the taxpayer had filed short form, together with fines, penalties and

interest. No one in their right mind wants the IRS to compute their taxes

without using their legitimate deductions, etc., and then tacking on interest

and penalties. (United States v Cheek 3 F.3d 1057, 1063 [7th Cir.,

1994]; United States v Barnett, 945 F.2d 1296, 1300 [5th Cir., 1991] and

Schiff v US 919 F.2d 830, 832 [2nd Cir., 1990])

Some of the

other arguments for not paying federal taxes are: taxpayers are not

"persons" as defined by the IRS and, therefore, are not subject

to taxes. (United States v Karlin 785 F.2d 90, 91 [3d Cir, 1986]) • The IRS must file an income tax return for any taxpayer

who does not file. This relieves the citizen of the "burden,"

of filing, and relieves them of the obligation to pay if the IRS does

not file on their behalf. Section 6020[b], which is cited, merely

provides the IRS with the mechanism to determine tax liability on those

who do not file. The liability includes the taxes that would be paid if

the taxpayer had filed short form, together with fines, penalties and

interest. No one in their right mind wants the IRS to compute their taxes

without using their legitimate deductions, etc., and then tacking on interest

and penalties. (United States v Cheek 3 F.3d 1057, 1063 [7th Cir.,

1994]; United States v Barnett, 945 F.2d 1296, 1300 [5th Cir., 1991] and

Schiff v US 919 F.2d 830, 832 [2nd Cir., 1990])

![]() The

dominant argument of the anti-tax advocates is that because the 16th Amendment

was fraudulently ratified, none of the laws stemming from it are binding

on the American people. This line of reasoning also suggests that

the federal judiciary has steadfastly refused to address the fraud first

acknowledged by Archer during the appeal of United States v

George & Marion House in 1985. Other than tax court decisions

which are IRS agents pretending to be judges, the federal courts skirted

the issue when it purportedly addressed the question of the legality of

the 16th Amendment four times. The first time was by the notorious 9th

Circuit in 1986 in the case of United States v Stahl, (792 F.2d 1438,

1441 [9th Cir., 1986], cert. denied 479 US 1036 [1987]). A three judge

panel of the 9th Circuit weighed Stahl's argument and found that "...the Secretary of State's certification under authority of

Congress that the 16th Amendment has been ratified by the States and has

become part of the Constitution is conclusive upon the courts." The

9th Circuit danced around the issue without ever addressing the 73 year-old

fraud, ruling that the 16th Amendment was lawfully ratified. In United

Sates v Foster, 789 F.2d 457 [7th Cir., Cert. denied, 479 US 83 [1986] the 7th US Circuit Court rejected the claim of the defendant that the

16th Amendment was fraudulently ratified, adding to the precedents that

have validated the 16th Amendment. Additional rulings have affirmed the

validity of the 16th Amendment, the fraud notwithstanding. Two are Miller

v United States 868 F.2d 236, 241 [7th Cir., 1989] and Bowman v United

States, 920 F.Supp.623n.1 [E.D. Pa. 1995].

The

dominant argument of the anti-tax advocates is that because the 16th Amendment

was fraudulently ratified, none of the laws stemming from it are binding

on the American people. This line of reasoning also suggests that

the federal judiciary has steadfastly refused to address the fraud first

acknowledged by Archer during the appeal of United States v

George & Marion House in 1985. Other than tax court decisions

which are IRS agents pretending to be judges, the federal courts skirted

the issue when it purportedly addressed the question of the legality of

the 16th Amendment four times. The first time was by the notorious 9th

Circuit in 1986 in the case of United States v Stahl, (792 F.2d 1438,

1441 [9th Cir., 1986], cert. denied 479 US 1036 [1987]). A three judge

panel of the 9th Circuit weighed Stahl's argument and found that "...the Secretary of State's certification under authority of

Congress that the 16th Amendment has been ratified by the States and has

become part of the Constitution is conclusive upon the courts." The

9th Circuit danced around the issue without ever addressing the 73 year-old

fraud, ruling that the 16th Amendment was lawfully ratified. In United

Sates v Foster, 789 F.2d 457 [7th Cir., Cert. denied, 479 US 83 [1986] the 7th US Circuit Court rejected the claim of the defendant that the

16th Amendment was fraudulently ratified, adding to the precedents that

have validated the 16th Amendment. Additional rulings have affirmed the

validity of the 16th Amendment, the fraud notwithstanding. Two are Miller

v United States 868 F.2d 236, 241 [7th Cir., 1989] and Bowman v United

States, 920 F.Supp.623n.1 [E.D. Pa. 1995].

In an off-the-record

exparte meeting with the magistrate during the 1983 income tax evasion

trial of George and Marion House, Western District of Michigan

Chief US District Court Judge Wendell A. Miles told the House lawyer, Lowell Becraft, that issues concerning irregularities and

possible fraud in the certification of the resolution had to be dealt

with by Congress, not the courts.  Miles told Becraft that Congress alone had the authority to investigate

the suspected fraud. On the record, inside the courtroom, Miles noted that as far as the courts are concerned, "The sixteenth amendment was duly certified by the Secretary of State. [And]...because

defendants have not alleged that the minor variations in capitalization,

punctuation and wording of the various state resolutions are materially

different in purpose or effect from the language of the congressional

joint resolution proposing adoption of the 16th Amendment, and because

the 16th Amendment has been recognized and acted upon since 1913, the

Court rejects defendants' argument that the 16th Amendment is not a part

of the United States Constitution."

Miles told Becraft that Congress alone had the authority to investigate

the suspected fraud. On the record, inside the courtroom, Miles noted that as far as the courts are concerned, "The sixteenth amendment was duly certified by the Secretary of State. [And]...because

defendants have not alleged that the minor variations in capitalization,

punctuation and wording of the various state resolutions are materially

different in purpose or effect from the language of the congressional

joint resolution proposing adoption of the 16th Amendment, and because

the 16th Amendment has been recognized and acted upon since 1913, the

Court rejects defendants' argument that the 16th Amendment is not a part

of the United States Constitution."

Until Congress addresses the fraud—which likely will never happen—the 16th Amendment will stand as law. With it, so will the federal income tax. That means tax protesters like Greg Dixon, Sr. will never win in the courts where the battle needs to be fought. As Judge Miles said, the federal court system will continue to rule that the 16th Amendment is valid if for no other reason than because the federal courts have made countless legal decisions that stripped thousands of American taxpayers of their wealth and property to satisfy tax liens that should never have been granted by the courts.

The tax seizure of Indianapolis Baptist Temple should never have happened—and would not have except for the extremism of its senior pastor. When the church was founded in 1950, it was duly incorporated as a 501[c]3, which meant it was not required to pay taxes on the income it derived from the tithes of its congregation. As long as its 501[c]3 status remained operative, IBT remained tax exempt. As IBT grew and added salaried staff, the church filed W-2s on the incomes of its people and everyone—pastor Gregory J. Dixon included—filed their 1040s and paid their taxes. Had Dixon not been influenced by anti-tax extremists in the militia movement, the seizure would never have occurred because Dixon would never have surrendered his church's tax exemption or attempted to provoke a confrontation with the government that ultimately—he had to know—he would lose.

Sadly, every tax protester in the United States will ultimately have his day in court. All of them will lose—just as IBT lost. Just as Allen Lee Buchta lost. Just like George and Marion House lost. Just like scores of American who bought into the notion that Americans don't have to pay federal income taxes. Tragically, those who buy the soap box sales pitch will believe, for a few years, that the myth was fact—and the seminars they attended were well worth the price since it will appear through the conspiracy smoke and mirrors that they no longer have to pay taxes. When enough time has elapsed: when the back taxes, fines, penalties and interest consume the assets of the protester, and when the protester has racked up about ten years of jail time, someone worse than Freddie Krueger will show up at his door. The tax man will appear and his worst nightmare will come true.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.