News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

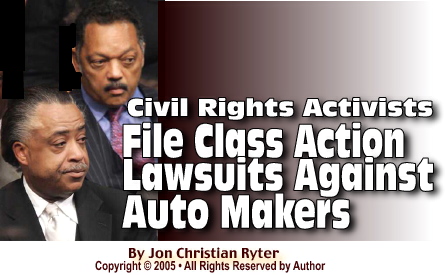

![]() hen

their latest reparations-style civil rights initiative was unfurled

by Jesse Jackson's Rainbow/PUSH Alliance against

AmSouth Bank on Nov. 11, 2004 barely a single media

talking head turned towards Birmingham, Alabama, including the

Birmingham News—even though AmSouth Bank,

which is headquartered there, had

just been exonerated from a similar lawsuit when an African-American

car buyer alleged (through her lawyer) that she was the victim

of lending discrimination by AmSouth Bank.

hen

their latest reparations-style civil rights initiative was unfurled

by Jesse Jackson's Rainbow/PUSH Alliance against

AmSouth Bank on Nov. 11, 2004 barely a single media

talking head turned towards Birmingham, Alabama, including the

Birmingham News—even though AmSouth Bank,

which is headquartered there, had

just been exonerated from a similar lawsuit when an African-American

car buyer alleged (through her lawyer) that she was the victim

of lending discrimination by AmSouth Bank.

Suing banks and automobile industry finance companies for lending practice "discrimination" against African-Americans and Hispanics had evolved into a very profitable proposition by a handful of anti-discrimination law firms in the United States who cut their activist teeth on workplace discrimination and from "protecting" minority home buyers from mortgage lending discrimination.

On

Nov. 3, 2004 Jesse Jackson picked up the gauntlet dropped

by the law firm of Terry & Gore when US District

Court Judge Todd Campbell ruled, in July, 2003, that Michael

Terry's plaintiff in Osborne v AmSouth Bank

had not been "victimized" by AmSouth because

she was black. In fact, the court found that not only was Osborne's

interest rate not discriminatorily marked up (dealers have the

option of inflating the rate of interest you pay to the bank or

finance company by as much as 3%.) Part of this sum represents

their "commission" for selling the loan to that lending

institution. Lending institutions also inflate the interest rates

based on the "risk." Customers

with bad credit or slow pay histories—not only on other bank,

mortgage, or finance company loans, but your telephone and utility

bills as well—are penalized by being charged a higher interest

rate. (In fact, if they have a bad pay or slow pay credit history,

they will also find they are "rated" [charged a higher

premium for the same insurance coverage that has nothing to do

with whether or not they have had accidents or speeding tickets]

when they purchase car insurance on that new car they just bought.)

On

Nov. 3, 2004 Jesse Jackson picked up the gauntlet dropped

by the law firm of Terry & Gore when US District

Court Judge Todd Campbell ruled, in July, 2003, that Michael

Terry's plaintiff in Osborne v AmSouth Bank

had not been "victimized" by AmSouth because

she was black. In fact, the court found that not only was Osborne's

interest rate not discriminatorily marked up (dealers have the

option of inflating the rate of interest you pay to the bank or

finance company by as much as 3%.) Part of this sum represents

their "commission" for selling the loan to that lending

institution. Lending institutions also inflate the interest rates

based on the "risk." Customers

with bad credit or slow pay histories—not only on other bank,

mortgage, or finance company loans, but your telephone and utility

bills as well—are penalized by being charged a higher interest

rate. (In fact, if they have a bad pay or slow pay credit history,

they will also find they are "rated" [charged a higher

premium for the same insurance coverage that has nothing to do

with whether or not they have had accidents or speeding tickets]

when they purchase car insurance on that new car they just bought.)

In Osborne's case, not only was her loan not "marked up" (charged more for her loan) when she bought her car, every other auto loan purchased by AmSouth during the month the plaintiff purchased her car contained interest rates higher than the plaintiff's. In addition, all of the other car loans made that month by AmSouth Bank were made to white consumers. Thus, not only was Osborne not discriminated against, an argument could have been made by the white consumers financed by AmSouth that month that they had been—even though no consumers of any stripe or color had been targeted by AmSouth. It is unclear what made Osborne think she had been discriminated against by AmSouth Bank and why she ended up as a client of Terry & Gore. "The plaintiffs," Campbell wrote into his decision, "were actually treated better than other non-African American customers during the same period," adding that the markup rate alleged by the plaintiff was under the average markup for white customers during the same period.

"When we filed the suit," Michael Terry, a partner in the Nashville, TN-based Terry & Gore law firm, said, "we did so on the suspicion that the Osbornes may have been discriminated against. We had to file the suit just to get the information from AmSouth on what the markup for the Osbornes was. It turned out they weren't victimized. But that doesn't exonerate AmSouth from other alleged infractions. Until lenders agree to disclose their markup rates, as well as the models on which those rates are determined, they can expect more lawsuits." Excuse me? That was a frivolous lawsuit.

Terry & Gore filed a costly legal action against AmSouth Bank on a "hunch" that the bank may have done something wrong. Without any evidence that they had. Bluntly speaking, I can't imagine that the Osbornes sought out Terry & Gore and said, "I think the bank stiffed us by marking our loan up too much. Can you represent us and see if you can get 1% or 2% of the interest back? " Be honest. Before reading this, did you even know that car dealers could "mark up" a loan—charging you up to 3% more interest than the lending company agreed to charge to finance your car? Of course you didn't. If the Osbornes didn't go to them, believing they had been overcharged, did Terry & Gore advertise for minorities who had recently purchased cars financed by AmSouth Bank, suggesting they had been overcharged because they were black?

There is something inherently flawed with a legal system—or the judges who control them—that allows lawyers to file lawsuits without sufficient evidence to legally support the plaintiff's allegation of wrongdoing. Suspicion of wrongdoing is not evidence of wrongdoing. In our politically-correct social justice federal court system, suspicion of wrongdoing is sufficient grounds to have your lawsuit placed on the court's docket.

Today, activist judges allow civil rights lawyers to file discrimination lawsuits that are nothing more than legally-sanctioned fishing expeditions that allow the plaintiff's lawyers to depose those being sued, or to subpoena their records, in order to search for any "evidence" that will support the vague suspicion that some form of discrimination has taken place and that the plaintiff is a victim.

This bias exists throughout our society. It is regretfully compounded by civil rights activists who deliberately portray their minority constituents—whether the civil liberties activists are themselves black, Jewish or Anglo-Saxon—in the image of the impoverished Depression-era southern black. Unfortunately they have done it for so long, many of America's most prominent civil rights law firms actually believe the prototype they created when, in fact, black America has a well-developed, financially solvent, middle class which, like their white counterparts, has escaped the inner urban setting in favor of gated communities outside the metropolitan centers where they work. Because most civil rights activists today carry a stereotyped negative impression of the minority constituents they represent in the court of public opinion, they enter the legal arena with an erroneous societal profile of their constituents that do not help their advocacy.

A study

done by Vanderbilt University professor Mark A. Cohen on

the markup of loans at AmSouth Bank loans suggested

to Cohen that, on average, black consumers paid AmSouth

Bank $247 more than white consumers in additional fees

not related to credit worthiness.  Cohen

based his conclusions on the data of credit transactions received

from AmSouth Bank. The data included 31,549 active

contracts that were written on cars sold by various Tennessee

car dealers from 1997 to 2003. All of the deals were financed

by AmSouth Bank. None of the

transactions gave any indication of the race or ethnic characteristics

of the customers. The fact that race and ethnicentricity

did not appear on the any of the documents should have been a

red flag to Cohen that his client, Terry & Gore

may have been chasing mythical monsters. It didn't. But the law

firm wasn't looking for the truth in the AmSouth

files—they were seeking their perception of truth.

And, that Cohen could provide.

Cohen

based his conclusions on the data of credit transactions received

from AmSouth Bank. The data included 31,549 active

contracts that were written on cars sold by various Tennessee

car dealers from 1997 to 2003. All of the deals were financed

by AmSouth Bank. None of the

transactions gave any indication of the race or ethnic characteristics

of the customers. The fact that race and ethnicentricity

did not appear on the any of the documents should have been a

red flag to Cohen that his client, Terry & Gore

may have been chasing mythical monsters. It didn't. But the law

firm wasn't looking for the truth in the AmSouth

files—they were seeking their perception of truth.

And, that Cohen could provide.

Cohen hired a Woodstock, Georgia regulatory compliance consulting firm, Compliance Technologies, Inc. to extrapolate the data. CTI calculated that 29,281 of the 31,549 contracts were for white customers, 2,068 were for black customers, and the remaining 190 contracts were for Hispanic customers. Clearly the detective work was flawed since GTI's conclusions, which were based on guesswork, convinced Terry & Gore that AmSouth Bank had discriminated against hundreds of minority customers when absolutely no instances of pricing discrimination have yet been proven against AmSouth. Since none of those whom Michael Terry suspected had been victims of discriminatory markups were part of Osborne v AmSouth Bank, Judge Todd Campbell found in favor of AmSouth, suggesting that, at least, the formula used by CTI to sustain its allegations was flawed. From hindsight, it would seem that CTI used the same flawed logic that has colored the view of our politically-correct society since Lyndon B. Johnson's Great Welfare Society was created—that the highest interest rates are always paid by the African American buyer.

When

Wyman Gilmore, the plaintiff's attorney in Smith v Chrysler

Financial Services, argued his case before the US District

Court for the District of New Jersey, he postulated that Cohen's

estimated $247 markup "...was costing [minority] consumers

several hundred to more than $1,000 per car, depending on the

value of the car and the length of the loan." Smith

v Chrysler Financial Services became part of the class action

suit against Daimler-Chrysler last year. It was

settled in June—two months after the class action against

Ford Motor Credit Company and Primus Automotive

Financial Services, a Ford Motor Company

subsidiary was settled. Preceding those class action suits was

one against General Motors Acceptance Corporation

[GMAC]—the nation's second largest auto lender. All

three of the actions stemmed from allegations that banks, finance

companies and automobile industry lending institutions regularly

discriminate against minorities.

When

Wyman Gilmore, the plaintiff's attorney in Smith v Chrysler

Financial Services, argued his case before the US District

Court for the District of New Jersey, he postulated that Cohen's

estimated $247 markup "...was costing [minority] consumers

several hundred to more than $1,000 per car, depending on the

value of the car and the length of the loan." Smith

v Chrysler Financial Services became part of the class action

suit against Daimler-Chrysler last year. It was

settled in June—two months after the class action against

Ford Motor Credit Company and Primus Automotive

Financial Services, a Ford Motor Company

subsidiary was settled. Preceding those class action suits was

one against General Motors Acceptance Corporation

[GMAC]—the nation's second largest auto lender. All

three of the actions stemmed from allegations that banks, finance

companies and automobile industry lending institutions regularly

discriminate against minorities.

Judges allow deposition fishing expeditions simply because our politically-correct society accepts, as fact, the cancer that all minorities are victims of discrimination by the more affluent white majority. Politically-correct magistrates believe that past injustices should be remedied through a litany of solutions that allow minorities to file legal actions without offering pretrial evidence to support the allegations they have been wronged by the party they are attempting to sue.

Using Cohen's flawed conclusions that minority customers are always charged a higher interest rate, the Rainbow Coalition saw a rare opportunity to join the rash of civil rights activists getting rich from suing banks and loan companies over discriminatory loan practices that target minorities. The floodgates on class action lawsuits opened when Nissan Motor Acceptance Corporation was sued for lending discrimination in 1998 under the Equal Credit Opportunity Act . The Clinton Administration amended the 1974 Equal Credit Opportunity Act and inadvertently opened the door for a unique rash of lawsuits against banks, loan companies and auto company lending institutions. The plaintiffs' lawyers then used the discovery process to search for evidence to prove their suspicions had legal standing.

Nissan settled out-of-court with a payment of $7.5 million. That settlement opened the door even wider for legal actions against American Honda Finance Corp, BankONE, Bank of America, and USBank—all of whom agreed to settle to avoid the negative publicity of a trial. In the first six cases the defendants agreed to pay the plaintiffs' attorneys more than $32.4 million. That's a pretty hefty payday for a "crime" that didn't happen. Unfortunately, in politically-correct America, the defendants knew if they went to trial, the negative publicity would be so damaging even if they won it would cost them far more in advertising to offset the negative newspaper headlines than the settlement. It was simply cheaper to settle. So, they did.

The law firms at the heart of the rash of largely frivolous discrimination lawsuits under the Equal Credit Opportunity Act were the National Consumer Law Center [NCLC], The Law Offices of Clint Watkins, the Gilmore Law Office, Terry & Gore, P.C., Bernstein Litowitz Berger & Grossman LLP and Grant & Ruddy. NCLC is the only law firm that has participated as co-counsel in all of the lending discrimination class action lawsuit that has been filed to date. Lawsuits were also filed against Ford Motor Credit Company [FMCC] and Primus Automotive Financial Services (which processes Ford branded Mazda America Credit; Land Rover Credit and Jaguar Credit), General Motors Acceptance Corporation [GMAC] and Daimler-Chrysler Services. The American Big Three decided to fight the allegations since they knew the charges were bogus. Car manufacturers, like any other free enterprise business, wants to sell product. And, they don't care who that customer is—as long as they pay for the products they buy.

The Equal Credit Opportunity Act of 1974 as amended in 1996 obligated America's retail establishments and the lending community to sell to high risk consumers—but it provided them with a monetary offset to minimize the financial risk involved in selling to people who had previously filed bankruptcy or who have slow pay credit histories, or were generational welfare recipients without gainful employment. Banks and other lending institutions were allowed to adjust their interest rates to compensate for the increased risk. In the event the lender still felt the risk outweighed the benefit, the lender could simply decline to issue the loan. If they did under the Equal Credit Opportunity Act, the law required them to notify the consumer exactly why they were declined. If the consumer felt he or she had been discriminated against, they could seek redress in the courts. Since 1996, scores of civil rights law firms have filed thousands of complaints in the interest of minority American clients. Since the start of the housing boom in the mid-1990s, hundreds of discrimination lawsuits have been filed by minority citizens who have been denied financing for the homes of their dreams.

But today's civil rights bonanza is the class action lawsuits targeting the automotive lending institutions. Not just because the interest markups on high risk buyers make it appear that discrimination has taken place, but because low income buyers must stretch out their payments over much longer periods of time than those making more money in order to get them low enough to qualify for a new car loan. That also looks like discrimination. The perception of wrongdoing is generally enough to convince a jury that discrimination has taken place.

Under the Equal Credit Opportunity Act, lending institutions are given too much flexibility to adjust interest rates on existing contracts if the lending institution has reason to believe the borrower is experiencing financial problems and, as a result, will likely begin falling behind in their own installment payments.

This

is now a common practice with credit card companies. Just like

automobile lending institutions who have been forced to lower

their interest rates to meet competition, credit card companies

had to do the same thing—with the same results.  Many

of the banks offering credit cards have had to offer interest

rates so low that the cards are not profitable for a year a more—providing

the cardholder does not become delinquent. Taking advantage of

the option granted them by providing credit cards to "high

risk" consumers, credit card companies are exercising their

"right" to double or triple the interest charged if

the cardholders fall behind on their installment payments. Apparently

not enough cardholders have fallen behind, so credit card companies

expanded the interpretation of "installment payments"

to include your telephone and electric bills.

Many

of the banks offering credit cards have had to offer interest

rates so low that the cards are not profitable for a year a more—providing

the cardholder does not become delinquent. Taking advantage of

the option granted them by providing credit cards to "high

risk" consumers, credit card companies are exercising their

"right" to double or triple the interest charged if

the cardholders fall behind on their installment payments. Apparently

not enough cardholders have fallen behind, so credit card companies

expanded the interpretation of "installment payments"

to include your telephone and electric bills.

On

March 1, 2005 US District Court Judge Aleta A. Tauger in

Nashville heard Case #3-02-0382, Laytonya Claybrooks, et

al. v Primus Automotive Financial. In her decision Tauger

ruled that allowing auto dealers to exercise discretion in marking

up the interest rates on loans generated at the dealerships was

inherently discriminatory. In prior cases, no less than six other

federal judges approved settlement agreements in which lenders

permitted the discretionary use of markups by dealers—holding

the practice to be legal. In her written decision, Tauger

stated emphatically in her decision that the practice of discretionary

markups by the dealer—who receives all or a portion of the

overcharge—is, in and of itself, unlawful. Joseph A. Woodruff,

a lawyer and writer for American Banker magazine

believes there needs to be a common sense change in the lending

laws to protect consumers from this form of abuse.

On

March 1, 2005 US District Court Judge Aleta A. Tauger in

Nashville heard Case #3-02-0382, Laytonya Claybrooks, et

al. v Primus Automotive Financial. In her decision Tauger

ruled that allowing auto dealers to exercise discretion in marking

up the interest rates on loans generated at the dealerships was

inherently discriminatory. In prior cases, no less than six other

federal judges approved settlement agreements in which lenders

permitted the discretionary use of markups by dealers—holding

the practice to be legal. In her written decision, Tauger

stated emphatically in her decision that the practice of discretionary

markups by the dealer—who receives all or a portion of the

overcharge—is, in and of itself, unlawful. Joseph A. Woodruff,

a lawyer and writer for American Banker magazine

believes there needs to be a common sense change in the lending

laws to protect consumers from this form of abuse.

In the six-year old racial discrimination class action suit against GMAC that was finally argued in February, 2004, the statistics compiled for Cohen suggested that black borrowers paid an average of $1,229.00 in additional interest over the life of the loans, and that the African American borrowers were three times as likely as whites to be charged markups on loans. In the GMAC case, Cohen had access to 6.2 million GMAC car loans, but limited his analysis to 1.5 million loans in which, he claimed, race could be determined through drivers' license files and "other sources." GMAC spokesman James Farmer said GMAC does not ask the race of loan applicants, nor do they ask any questions that could be linked to race or ethnic characteristics since loan approval is contingent only on the applicant's ability to repay the loan, and their credit history to verify that they are credit worthy.

When the GMAC lawsuit was certified as a class action by the US District Court Judge, the US Court of Appeals reversed the certification, holding that as long as plaintiffs were seeking monetary relief, a class action was inappropriate because the court would then be obligated to physically examine the financing contract of every class member to determine whether they had been discriminated against, and by how much each class member had been damaged. Before the court could dismiss the action, the plaintiffs' lawyers dropped their money demands. Instead, they amended their action, asking for whatever declaratory and injunctive relief the court deemed appropriate. The plaintiffs themselves were recertified. This time the lawsuit passed muster.

On February

10, 2004 GMAC agreed to a settlement. In the settlement,

GMAC had to agree to limit their dealer markups to no more

than 2.5%. Prior to the court action, dealers could charge unsuspecting

car buyers as much as 5% more interest than that which GMAC

agreed to accept the deal at.  Staurt

Rossman, the lead attorney for the NCLC hailed the

settlement as soemthing that would ultimately prove to be good

for all consumers even though initially the decision impacted

only GMAC customers. "Prior to this lawsuit,"

Rossman said, "there was no limit on how much GM

dealers could mark up loans. This settlement legally guarantees

a limit on the markup of 2.5%, and in some cases, no more than

2%. This settlement will save consumers tens of millions of dollars

each year and will positively change the dynamics of dealer-arranged

financing....We applaud GMAC for accepting important protections

which will benefit consumers throughout the country. However,

we will continue to advocate further changes in credit pricing

by other lenders in this industry seeking to provide further relief

and more disclosure in order to insure tha all consumers are treated

fairly." Rossman is absolutely correct about dealer

markups on interest specifically because consumers don't know

this is not a required "add-on" by the bank of dealer

financial institution. It's a perk for the dealer for pushing

their financing over some other company.

Staurt

Rossman, the lead attorney for the NCLC hailed the

settlement as soemthing that would ultimately prove to be good

for all consumers even though initially the decision impacted

only GMAC customers. "Prior to this lawsuit,"

Rossman said, "there was no limit on how much GM

dealers could mark up loans. This settlement legally guarantees

a limit on the markup of 2.5%, and in some cases, no more than

2%. This settlement will save consumers tens of millions of dollars

each year and will positively change the dynamics of dealer-arranged

financing....We applaud GMAC for accepting important protections

which will benefit consumers throughout the country. However,

we will continue to advocate further changes in credit pricing

by other lenders in this industry seeking to provide further relief

and more disclosure in order to insure tha all consumers are treated

fairly." Rossman is absolutely correct about dealer

markups on interest specifically because consumers don't know

this is not a required "add-on" by the bank of dealer

financial institution. It's a perk for the dealer for pushing

their financing over some other company.

Dealer markups should be illegal in every State since it's an incentive for the dealer to place the loan through a particular finance company. And, of course, it benefits only the dealer at the expense of the customer. Of course, it can—and has—been argued that if it was not for this particular incentive most dealerships would not waste their time trying to get high risk car buyers financed. Today, with extremely low interest rates, the high risk customer is actually more profitable than those who always pay like clockwork.

In February,

2004, three months after Jesse Jackson filed a new class

action suit against AmSouth Bank over alleged lending

discrimination, Voices for Morality, a Chicago-area racial

equality group filed a class action suit against Daimler-Chrysler

AG for discriminatory lending practices, Smith v Chrysler

Financial Company, Case No. 00-CV-6003 and enlisted the support

of Democratic presidential candidate Rev. Al Sharpton to

disrupt Chrysler's product convention three days after the presidential

election in 2004 in order to publicize what six Chicago-area black

civil rights activists believed was racial discrimination in the

company's lending policy. Voices for Morality believed

Chrysler deliberately and systematically denied

low-interest vehicle financing to creditworthy African-Americans.

Holding

a press conference designed to embarrass Chrysler,

Sharpton threatened to get the US Justice Department involved

in an investigation of Daimler-Chrysler AG, telling

the media that "...in the past, we had to fight blatant

racism. now we're dealing with institutional racism. We've gotten

to an era where people are much more subtle and more manicured.

Jim Crow is now Mr. James Crow, Jr., Esquire."

Holding

a press conference designed to embarrass Chrysler,

Sharpton threatened to get the US Justice Department involved

in an investigation of Daimler-Chrysler AG, telling

the media that "...in the past, we had to fight blatant

racism. now we're dealing with institutional racism. We've gotten

to an era where people are much more subtle and more manicured.

Jim Crow is now Mr. James Crow, Jr., Esquire."

Settling faster than Ford or General Motors, Daimler-Chrysler Services agreed, in addition to the declaratory and injunctive relief sought, to contribute $1.8 million to specific "nonprofit groups" to fund consumer education programs on how to borrow money, and the pitfalls of dealing with businesses that markup interest rates. US District Court Judge Dennis M. Cavanaugh will hold a hearing to decide if the settlement agreement should be approved.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.