News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet

Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

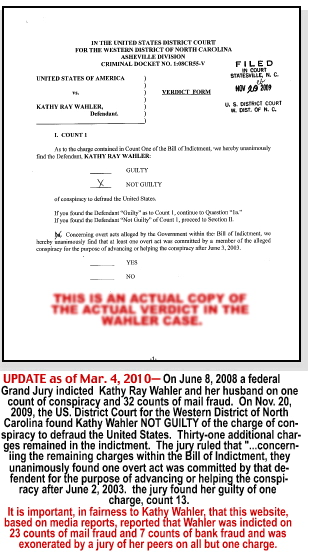

NOTE:

JURY VERDICT ON ONE

DEFENDENT, KATHY WAHLER

NOW INCLUDED IN THIS ARTICLE

JURY VERDICT TOOK PLACE ON NOV. 20, 2009. THIS VERDICT

EXONERATES WAHLER OF ALL BUT ONE CHARGE AGAINST HER.

THE INFORMATION SENT TO ME DOES NOT MENTION THE OTHER

DEFENDENDENTS. This website pledges to always tell the turth as we know

it to be. Wahler, like the other co-defendents were charged with serious

felonies. Since she was mentioned as one of those indicted, in fairness

to her, this website needed to publish the jury's finding on her behalf.

North

Carolina couple faces 300 years

in prison in bank fraud scheme from the handbook

of the debt elimination movement

The debt elimination movement

was birthed from the tax protest movement which itself was born in opposition

to the federal income tax. It can honestly be said that the anti-tax movement

was one of the catalysts that started the American Revolution.  And,

while there were tax protesters in contemporary America as early as 1918,

the organized tax protest movement in the United States began in 1948

when Connecticut industrialist Vivien Kellems, a suffragette in

her early years, refused to withhold payroll taxes from her employees

at Kellems Cable Grips, Inc. because the Truman White House

and the 81st Congress refused to roll back the tax increases they enacted

during World War II. And although President Franklin D. Roosevelt

pledged that the tax increases would be repealed at the end of the national

emergency caused by World War Ii, the Democratically-controlled Congress

has never seen a tax it was not prepared to make permanent.

And,

while there were tax protesters in contemporary America as early as 1918,

the organized tax protest movement in the United States began in 1948

when Connecticut industrialist Vivien Kellems, a suffragette in

her early years, refused to withhold payroll taxes from her employees

at Kellems Cable Grips, Inc. because the Truman White House

and the 81st Congress refused to roll back the tax increases they enacted

during World War II. And although President Franklin D. Roosevelt

pledged that the tax increases would be repealed at the end of the national

emergency caused by World War Ii, the Democratically-controlled Congress

has never seen a tax it was not prepared to make permanent.

The current tax protest movement

stemmed from the 1986 book The Law That Never Was, Part One

by M. J. "Red" Beckman and William J. Benson and

Part Two was authored solely by Benson. Benson,

one of the icons of the anti-tax movement, was found guilty of two counts

of willful failure to file income tax and a third charge of tax evasion

in the US District Court of Northern Illinois in 1991. The magistrate

was Judge John F. Grady. The US Court of Appeals for the

7th Circuit overturned his conviction based on the instructions Grady

gave to the jury that pretty much obligated them to find Benson

guilty.  (US

v Benson 941 F.2d 598).

(US

v Benson 941 F.2d 598).

Benson was retried and found guilty again. And, again, he appealed. This time the 7th Circuit upheld his conviction. In an interesting side note, in the 1960s Benson worked for Bethlehem Steel. He developed a seizure disorder from a bout of encephalitis and lost his job. He received disability for several years. In the 1970s he worked as a bartender at a bowling alley-cocktail lounge. To increase his income he took a part-time job in 1971 working for the Illinois Department of Revenue [IDOR] as a tax informant. In 1974 he became an IDOR investigator of tax scofflaws. He was fired in 1976. In 1983 Benson was working as a paralegal for attorney Andrew Spiegal who was defending Allen Lee Buchta on tax evasion charges. It was at this time that Benson met Red Beckman and the investigation of the fraudulent ratification of both the 16th and 17th Amendments began.

The debt elimination movement

came on the heels of the tax protest movement. Many of those who felt

they should be exempt from taxation apparently also felt they should be

exempt from paying the debts they lawfully incurred. In the debt elimination

movement, its proponents insist that since the Federal Reserve creates

money from debt, when you incur debt you are actually providing the Federal

Reserve with the money that is financing your own obligation, and that

your promissory note is actually a "deposit." Therefore, in

the collective mind of the debt elimination movement, the bank has as

much liability to the borrower as the borrower has to the bank. Why? Because,

they claim, the promissory note the bank claims as an asset is actually

your "asset." The movement cites a myriad of complex tax laws

which they admit that only tax attorneys—and their paralegals who

analyze mortgages and whatnots for "reversible error"—can

understand.  The

paralegals help you "legally" avoid paying those debts through

a mishmash of what they term are "legal loopholes" that are

used by the ultra-rich to avoid debt.

The

paralegals help you "legally" avoid paying those debts through

a mishmash of what they term are "legal loopholes" that are

used by the ultra-rich to avoid debt.

The hucksters of the debt elimination system insist the techniques they teach are highly confidential administrative procedures that were used for years to provide financially-strapped homeowners with clear titles to their homes. The advocates of debt erasing admit that, in the last few years, banks have chosen to renege on their agreement to convey homeowners who use these ploys with a clear deed once the debt is discharged. In these instances, of course, the debt is not discharged since those who avail themselves of the ploy use fraud to create the appearance the debt is discharged when no money actually changes hands. It's hard to image that those who found a way to manipulate the money system through a financial sleight-of-hand could imagine that what they are doing is anything but fraud.

The debt elimination movement

uses a variety of legal and and phony forms to temporarily obfuscate what

is actually nothing more than a paper shell game. Usually the huckster

starts by opening a Private Treasury Direct Account (which can be opened

by any US citizen for use to covert their T-bills or other government

securities into cash). Only, the huckster doesn't have any T-bills or

other securities which need to be cashed-in or transferred into cash.

The

debt movement also uses Bills of Exchange [BoE], which are international

promissory notes calling for a specific sum to be paid by one party to

another on a specific date. If the BoE is drawn on a bank, it becomes

a bank draft. Notices of International Commercial Claim are international

judgments usually in the area of maritime credit..Also part of the smoke

screen arsenal of the debt elimination people are a variety of other little

known banking procedures that do not apply to general consumers.

The

debt movement also uses Bills of Exchange [BoE], which are international

promissory notes calling for a specific sum to be paid by one party to

another on a specific date. If the BoE is drawn on a bank, it becomes

a bank draft. Notices of International Commercial Claim are international

judgments usually in the area of maritime credit..Also part of the smoke

screen arsenal of the debt elimination people are a variety of other little

known banking procedures that do not apply to general consumers.

The debt elimination movement uses every available ploy to confuse the banks and other financial institutions. However, financial institutions is a violation of a myriad of federal laws, all of which come under the jurisdiction of the US Secret Service which frowns when taxpayers (even those who don't pay their fair share) attempt to use the shell game to get clear title to property when no real money ever changes hands from debtor to creditor.

Which is precisely what a

federal grand jury bill of indictment against a Fletcher, North Carolina

couple, Edward William and Kathy Ray Wahler alleged. The

Wahlers were indicted at 10 a.m., June 8, 2008 along with co-conspirators

Richard Walser Turner of Huntersville, NC and Lewis Vincent

Hughes of Granite Falls, Washington.  The

Wahlers were indicted on one count of conspiracy, 23 counts of

mail fraud and 7 counts of bank fraud. The indictment alleges that the

Wahlers devised, and carried out, a scheme and artifice to defraud

several of their creditors and the Federal Reserve by submitting fictitious

documents to their creditors, to the Department of the Treasury, to other

government entities, and other financial concerns. The scheme, the indictment

read, was designed to deceive the IRS, private creditors, the Federal

Reserve and other financial institutions to treat the fictitious documents

they created as authentic checks or valid money orders in an attempt to

eliminate their personal mortgage and other debts.

The

Wahlers were indicted on one count of conspiracy, 23 counts of

mail fraud and 7 counts of bank fraud. The indictment alleges that the

Wahlers devised, and carried out, a scheme and artifice to defraud

several of their creditors and the Federal Reserve by submitting fictitious

documents to their creditors, to the Department of the Treasury, to other

government entities, and other financial concerns. The scheme, the indictment

read, was designed to deceive the IRS, private creditors, the Federal

Reserve and other financial institutions to treat the fictitious documents

they created as authentic checks or valid money orders in an attempt to

eliminate their personal mortgage and other debts.

The

plot began, the indictment said, when the Wahlers created a fraudulent

Private Treasury Direct Account [PTDA] or [USTDA] which they used

as the "strawman." To utilize the TDA, the Wahlers had

to create the illusion they had drawing rights on the TDA. On or about

March 22, 2001 the Wahlers, doing business as KMA, Inc., deposited

an altered Chase Bank check drawn on the account of Andrex Resources.

LLC, payable to their BB&T KMA, Inc. account. The check was in the

amount of $473,371.86. (When you want to commit a felony, make it large

enough that the banks you defraud are more interested in getting their

money back than prosecuting you.) Before Chase and BB&T discovered

the fraud, the indictment noted, the Wahlers withdrew $468,071.86

from the account.

The

plot began, the indictment said, when the Wahlers created a fraudulent

Private Treasury Direct Account [PTDA] or [USTDA] which they used

as the "strawman." To utilize the TDA, the Wahlers had

to create the illusion they had drawing rights on the TDA. On or about

March 22, 2001 the Wahlers, doing business as KMA, Inc., deposited

an altered Chase Bank check drawn on the account of Andrex Resources.

LLC, payable to their BB&T KMA, Inc. account. The check was in the

amount of $473,371.86. (When you want to commit a felony, make it large

enough that the banks you defraud are more interested in getting their

money back than prosecuting you.) Before Chase and BB&T discovered

the fraud, the indictment noted, the Wahlers withdrew $468,071.86

from the account.

Chase returned the check to BB&T as "non-negotiable" because it had been fraudulently altered. BB&T paid the check and demanded restitution from the Wahlers. Nothing happened. BB&T sued in Superior Court in Buncombe County, NC and won a judgment against the Wahlers on Dec. 9, 2002 for $473,371.86. The debt, of course, remained unsettled since the Wahlers had no money other than what they defrauded from Chase and BB&T.

On March 2, 2003 Kathy Ray Wahler, using methods she learned by studying the debt elimination system, opened a checking account at Bank of America with a $100.00 deposit. On March 28 Bank of America closed the account due to insufficient funds. On April 7, 2003 Kathy Wahler notified Bank of America that they would receive certain "instruments" through a "federal electronic fund transfer" although Wahler did not have a legitimate TDA from which to draw funds, or from which her bank could withdraw funds under her direction. At the same time Wahler and co-defendant Richard Walser Turner send various legal devices including a Nonnegotiable Chargeback and a Declaration and Treaty of Peace to the World to several federal and State agencies—including the US Treasury (which immediately made it a matter for the Secret Service). The Nonnegotiable Chargeback fraudulently opened a TDA in the name of Kathy Ray Wahler. The Declaration purported to grant Wahler $100 million dollars from the US Treasury. The document, signed by Wahler said, in part: "...I hereby claim my exemption and inheritance on right from my fiduciary heir within the United States corporation with an initial claim of $100 million to be returned to me by the fiduciary heir over an undetermined period of time at my discretion..." In this shell game, Turner was charged with aiding in producing the Declaration as well as various other items collectively referred to as the Chargeback. Turner is also charged with producing other documents to help Wahler with the Bank of America check #1401 including the FDIC Certificate of Service.

Check #1401, in the amount of $323,915.67 was to clear the mortgage on her home at 1120 Cane Creek Road in Fletcher. The check went to Countrywide Home Loans. It was the first of ten fraudulent checks written over a five day period by Kathy Wahler. Wahler decided to clear all of her debts. Check #1402, in the amount of $14,672.07 paid off the Wahler's Chase Platinum Visa card. Check #1403, in the amount of $7,001.19, paid off her Capital One Bank note. Check #1404, in the amount of $4,453.39 paid off her Choice Visa card. Her Juniper Bank note, in the amount of $992.88 was paid with check #1405. Check #1406, in the amount of $729.66 paid off her Providian Visa Card. Check #1407, made out to Capital One, paid off that credit card in the amount of $3,017.23. Another check, #1408, went to Chase Bank, in the amount of $2,957,54. And, finally, Citibank received $35,099.55 on check #1410. Collectively, this scam cost the taxpayers of the United States $395,630.51 Greedily, more was coming. Clearly, Kathy Wahler believed in complete debt elimination even though she lacked the financial wherewithal to pay those debts.

On May 13, 2003 Kathy Wahler sent a BoE as a "pre-authorized transfer" to the Buncombe County Superior Court on the Chase Bank-BB&T matter. The BoE listed a fictitious TDA number and included instructions to "remit at par" the amount of $486,685.93. At the same time, she sent a copy of the BoE to the US Treasury along with a "Copy of the Charging Instrument," and a "Certificate of Service" that was signed by Turner. The following day Wahler signed and submitted an "Affidavit of Tender of Payment" to Chase Bank, falsely affirming under oath that she made payment in full to Buncombe County Clerk to satisfy the judgment of $496,685.93 when, in fact, no such payment had been made.

In an article for the Liberty

Post written in May, 2008 by Highland Park, IL freelance writer Dick

Greb warned of the consequences of patriots listening to other self-described

patriots who believe they have captured the goose that lays golden eggs.

That goose is named "BoE." According to Greb, "This

is especially true when there are severe consequences to acting on mistaken

beliefs, such as is the case with a Patriot myth now remaking the rounds:

the issuance of Bills of Exchange [BoE].  This

myth is another incarnation of the strawman (if I only had a brain) theory.

Constitutional lawyer Larry Becraft posts the indictments of some

of those who have swallowed this poison; criminal charges are often filed

years after BoE's are used, while the promoters of this dangerous nonsense

want you to believe that a lack of response is proof that the government

accepts them as valid." Greb rightfully points out that

since an International BoE is a certificate of indebtedness of the nation,

then logic suggests anyone who fabricates one is guilty of counterfeiting

obligations or securities of the United States in violation of 18 USC

§ 471. Under 12 USC § 26, 27 defined at 32 USC § 5103,

in order to issue circulating specie, the Comptroller of the Currency

must issue a BoE. Without it, any notes issued by the Federal Reserve

are not legal tender. Greb subtitled his article "How to Make

Really Sure You End Up in Jail."

This

myth is another incarnation of the strawman (if I only had a brain) theory.

Constitutional lawyer Larry Becraft posts the indictments of some

of those who have swallowed this poison; criminal charges are often filed

years after BoE's are used, while the promoters of this dangerous nonsense

want you to believe that a lack of response is proof that the government

accepts them as valid." Greb rightfully points out that

since an International BoE is a certificate of indebtedness of the nation,

then logic suggests anyone who fabricates one is guilty of counterfeiting

obligations or securities of the United States in violation of 18 USC

§ 471. Under 12 USC § 26, 27 defined at 32 USC § 5103,

in order to issue circulating specie, the Comptroller of the Currency

must issue a BoE. Without it, any notes issued by the Federal Reserve

are not legal tender. Greb subtitled his article "How to Make

Really Sure You End Up in Jail."

Clearly, that will be the fate of the Wahlers, Turner and Lewis Vincent Hughes who collaborated with Edward Wahler through another unidentified unindicted co-conspirator in generating a BoE on or about Nov. 3, 2003 which demanded that BB&T send $14.78 million dollars to Hughes in Snohomish, Washington. Not to be outdone by his wife and his friends, Edward Wahler sent a BoE to Wells Fargo on Dec. 5, 2003 for $39 million. In their final lawsuit, filed April 3, 2008, the Wahlers, jointly, Hughes, and James Edward MacAlpine sued Andrew Romagnuolo for $100 million. Romagnuolo, the FBI Special Agent who seized the assets of Liberty Dollar, is being sued for violating the civil rights of the Wahlers, et al. In the June, 2008 indictment, Edward Wahler is represented by Sarah Elizabeth Wallace and William R. Tarpening. His wife is represented by Angela G. Parrott and Fredilyn Sison.

Greb was right. It took the federal government five years to come down on the Wahlers and their associates. Greb was also correct as to why they call the fake documents "strawmen." Greb's parallel was in comparing the document strawman with the Scarecrow in the Wizard of Oz. If you recall the tale, the Scarecrow was on a quest for a brain. Those who buy into the rhetoric spouted by the debt elimination crowd are just like the Scarecrow—a strawman in search of a brain.

Debt elimination scams are as numerous as the leaves on the trees. And Scarecrows (strawmen in search of a brain) like the Wahlers, Hughes and MacAlpine did not originate the myriad of scams that have been around for more than a half century, gaining popularity with urban consumers in the aftermath of the Carter years when super inflation robbed the assets of many Americans. In the late 1980s during the savings and loan debacle when the Resolution Trust Corporation was foreclosing on the cornfields of Midwestern farmers. Remember John Cougar Mellencamp's Farm Aid concert to benefit Iowa farmers? Mellencamp not only drew spectators and donors to the plight of the farmers who were losing their homes and land that had been in their families for generations, the Farm Aid concert also drew scores of mortgage elimination scam artists to the Midwest cornfields, and the debt elimination scam industry took on an allure of legitimacy because desperate farmers wanted to believe there was some easy way to save their homes and farms by letting a nonexistent federal legal loophole pay off their debt.

However, the US Treasury has published countless consumer alerts warning those who fall into the clutches of the debt elimination scam artists that instruments labeled Bills of Exchange, Due Bills, Redemption Certificates, and Bonds of Discharge are fraudulent since most of these instruments are used only in the international arena by government agencies, banks, or transnational corporations engaged in commerce with other nations, banks or transnational corporations. They are never used by consumers without money to escape lawful debt (particularly when, until lawful money actually changes hands, nothing happens—except those who try to perpetuate the fraud are charged with a felony for their efforts.) US Treasury alerts are intended to inform those who are told otherwise that even if such forms appear to look like legitimate documents, all of them are premised on fraudulent claims. They are worthless and have no legal validity. In addition, those who get caught up in the scam are guilty of violating 18 USC § 1345.

The Office of the Comptroller of the Currency, Compliance & Enforcement Division has issued several alerts for consumers in dire financial straits to beware of several debt elimination websites. The FBI also issued a warning on Dec. 8, 2003 on its website at http://www.fbi.gov/page2/dec03/fraud120803.htm advising those approached by debt elimination advocates that there are no loopholes and the scam artists prey on your desire to get something for nothing—or rather, for the upfront money the consumer is required to pay to lose everything they own plus risk going to prison.

A distraught consumer from La Mirada, California (who identified himself only as "Eric") used a Woodinville, Washington debt elimination company called Entirely Debt Free to escape an ocean of debt before he was swallowed by a legal tsunami. Entirely Debt Free provided him with all the fancy forms they said would protect his assets by using little known techniques to force the government to pay off his debt, or at least force his creditors to make a "reasonable settlement." Eric was obligated to pay $3,700 up front to get their "expedited debt package." Eric noted that the documents and forms contained in the debt package—which promised debt arbitration in his favor, and most of all, debt nullification—were completely worthless. The judge and the attorneys for his creditors had difficulty not laughing him our of court as they easily swept the phony documents aside.

Citibank easily got a judgment against Eric—and a lien on a home that was also in jeopardy of foreclosure. Eric was told by Entirely Debt Free that "...these cases never go to court because the program is so fabulous." When he lost the first round, Eric called Entirely Debt Free who assured him his Citibank judgment would be placed in their "judgment nullification" program. Of course, there was none other than a certificate demanding the nullification of the judgment that was tantamount to saying, "pretty please" to the court without any genuine legal precedents for vacating the judgment. The judgment nullification form simply demanded the court vacate the debt.

The Citibank judgment was the opening scene of Eric's financial nightmare come true. When his Wells Fargo Bank case went to court, the Wells Fargo lawyer cut through Entirely Debt Free's documents like they were soft butter cut with a straight razor. This time, seeing the handwriting on the wall before it became graffiti, Eric negotiated a settlement with Wells Fargo and is making payments on that debt. When Bank of America foreclosed on his home he used more Entirely Debt Free documents and found a local prosecutor looking at him for prosecution. He managed to save his home by arbitrating a payment settlement with MBNA Bank of America.

In 2005 a self-described "mortgage industry whistleblower" Kurt F. Johnson was arrested and charged in a 68-count debt elimination fraud indictment for mail fraud, bank fraud and a variety of conspiracy charges. Johnson, had previously served 5 years and 8 months for securities fraud and, of course, viewed himself as a victim of malicious prosecution by the federal government (thus, his self-described whistleblower status as he strived to teach "abused Americans" how to tame the hostile economic environment and own their own home without payng off the mortgage). Johnson and his partner, Dale Scott Heineman. founders of the Dorean Group, were found guilty by a federal jury in November, 2007 and sentenced on March 24, 2008. The Dorean Group, which was never incorporated nor licensed, was engaged in the mortgage elimination schemes since at least 2004.

Johnson was sentenced to 25 years, Heinemann was sentenced to 21 years. Indicted in November, 2007 were four Dorean Group "brokers," William Julian, 42 (from Cayce, SC), Charles D. Tobias, 58 (Longwood, FL), Sara J. Magoon, 29 (Hamilton, MT) and Farrel J. LeCompte, Jr., 36 (Kingwood, TX).

On Sept. 22, 2005 as the FBI concluded its investigation of Johnson and Heineman, US Attorney Kevin V. Ryan issued a statement in which he said: "Homeowners should be cautious of offers that sound too good to be true. The alleged scheme violates mortgage agreements between lender and borrower and taints property titles by recording false documents on the title of a home. Manipulating property titles and interfering with mortgage loans with the intent to defraud is illegal and will result in prosecution." Sadly, Scarecrows frantically searching for brains will continue to be suckered into "life is free if you use the right forms" schemes as long as gullible strawmen can be convinced that financial Santa Clauses, Easter Bunnies and the tooth fairy still exist.

Oh, and by the way, Scarecrows aside, once again you have my two cents worth.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.