News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

he

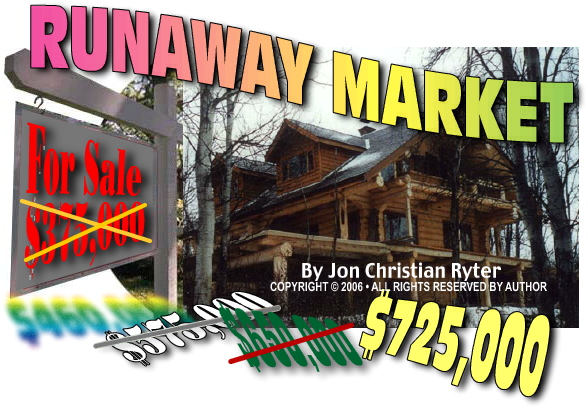

price of the typical 3-bedroom, 3-bath, 3,000-plus square foot

American home is skyrocketing beyond the ability of the atypical

American consumer to purchase one—or keep up with the spiraling

payments. The mortgage payment dilemma is based in large part

on the creative financing plans that are used today to qualify

moderate-income buyers for mortgage loans that everyone knows

is well beyond the ability of the average wage earner to pay when

the full mortgage payment matures in three to five years. On

the other end of the home market spectrum—because of the

megaprices being charged for older dwellings that were affordably

priced homes less than two years ago—new home sales are plummeting

because existing homeowners who want to "move up," are

finding fewer takers for overpriced older homes. In many parts

of the country, the sellers' market has completely vanished. The

"bidding wars" where prospective home buyers start at

the asking price and compete with one another has been replaced

with an ugly bearish buyers' market where consumers are balking

at older home

prices that have more than doubled over the past couple of years.

he

price of the typical 3-bedroom, 3-bath, 3,000-plus square foot

American home is skyrocketing beyond the ability of the atypical

American consumer to purchase one—or keep up with the spiraling

payments. The mortgage payment dilemma is based in large part

on the creative financing plans that are used today to qualify

moderate-income buyers for mortgage loans that everyone knows

is well beyond the ability of the average wage earner to pay when

the full mortgage payment matures in three to five years. On

the other end of the home market spectrum—because of the

megaprices being charged for older dwellings that were affordably

priced homes less than two years ago—new home sales are plummeting

because existing homeowners who want to "move up," are

finding fewer takers for overpriced older homes. In many parts

of the country, the sellers' market has completely vanished. The

"bidding wars" where prospective home buyers start at

the asking price and compete with one another has been replaced

with an ugly bearish buyers' market where consumers are balking

at older home

prices that have more than doubled over the past couple of years.

In many boom markets oversold homeowners are trying to refinance mushrooming mortgage payments that have resulted from the unique forms of creative financing that put them in homes they simply couldn't afford and should not have purchased. Fixed rate mortgages that were sold with 0% interest for one or two year years suddenly becomes mortgages with 6% interest—and the mortgage payments that they could barely afford at o% have ballooned. Or the homeowner was conjoled into taking an adjustable rate mortgage that is spiraling out of control each anniversary as the Fed continues to increase the prime rate to slow inflation—at the expense of home owners who were assured by overzealous mortgage brokers that the low interest gravy train express would not slow down in their lifetime.

Now,

in many of the slowing real estate markets, new home owners are

being asked how much of their genuine equity—the down payments

and the principle paid in their monthly mortgage payments—they

are willing to lose to get rid of their expensive albatross.  For

many, the American dream is fast becoming the Nightmare on Elm

Street. One such home buyer is San Diego, California homeowner

Cortney Henderson who celebrated her graduation from UCLA

San Diego with a Ph.D. in biomedical engineering by purchasing

a modest new home—for $540 thousand. Her home is a simple

one-story bungalow with an attached garage—the kind of house

you'd find in Montana or Idaho, or Rudyard or Trout Lake, Michigan

for $85,000 to $99,000.

For

many, the American dream is fast becoming the Nightmare on Elm

Street. One such home buyer is San Diego, California homeowner

Cortney Henderson who celebrated her graduation from UCLA

San Diego with a Ph.D. in biomedical engineering by purchasing

a modest new home—for $540 thousand. Her home is a simple

one-story bungalow with an attached garage—the kind of house

you'd find in Montana or Idaho, or Rudyard or Trout Lake, Michigan

for $85,000 to $99,000.

San Diego is a real estate "boom town." Unlike most California communities, it was a relatively affordable coastal city when Bill Clinton became president. You could purchase a nice 1,800 square foot 3-bedroom, 2-bath home for less than $300 thousand. When the city's real estate prices began their rapid upward spiral—reaching prices twice that of metropolitan Phoenix—the average household income of the San Diego wage earner was "spiraling" at the rate of about 5% as real estate has almost doubled in the past five years.

Henderson

should never have been given a half million dollar loan—regardless

of her credit score. Her $27,000.00 down payment (she earned her

down payment as an egg donor at a fertility clinic—something

you fertile housewives might think about when you and your husband

are trying to find the down payment for your new home) helped

cinch the deal. The rule-of-thumb used by mortgage bankers to

determine if you can afford the house you want to purchase is

whether your fixed monthly debt obligations—not just your

mortgage—are less than 25% of your net income. In Henderson's

case, her mortgage payment (including insurance and taxes) ate

up 70% of her gross earnings.  If

it was not for the $700 a month her boyfriend kicked in to help

her, Henderson would have already lost her home. If she

has an ARM [adjustable rate mortgage], the odds are better than

even that she would be forced to sacrifice her home in a "get-out-from-under-the-mortgage"

fire sale within a year or two. That's because, San Diego is viewed

as one of a dozen markets where major home pricing "corrections"

are about to take place. If that happens, Henderson will

be stuck with a home priced well above market, and will likely

be forced to dump the house for less than the current balance

of her mortgage to get rid of it.

If

it was not for the $700 a month her boyfriend kicked in to help

her, Henderson would have already lost her home. If she

has an ARM [adjustable rate mortgage], the odds are better than

even that she would be forced to sacrifice her home in a "get-out-from-under-the-mortgage"

fire sale within a year or two. That's because, San Diego is viewed

as one of a dozen markets where major home pricing "corrections"

are about to take place. If that happens, Henderson will

be stuck with a home priced well above market, and will likely

be forced to dump the house for less than the current balance

of her mortgage to get rid of it.

Rising interest rates are now making it increasingly hard to buy a home in most areas of the country as builders, aided by greedy county tax assessors who believe every home in the market increases in value when an out-of-state buyer is suckered by a real estate broker into paying a premium price for one home. Inflated home prices combined with spiraling interest rates are putting the brakes on homes in the most inflated markets. San Diego home prices have grown over 200% since 2000. The median home price at $607,000. Homes in San Bernadino and Ontario, California have risen over 195%, with the average home costing just under $400,000. Homes in the retirement paradise of Fort Meyers, Florida have risen 171%, with the average retirement home costing $267,000.

Real estate markets which have peaked, and where experts believe major pricing corrections will take place within the next 18 to 24 months (in order of vulnerability) are: [1] San Diego and San Marcos, California; [2] Nassau, New York; [3] Boston, Massachusetts and Santa Ana, Irvine and Anaheim, California (tied); [4] Sacramento and Arden-Arcade, California; [5] Ontario, Riverside and San Bernadino, California; [6] Oakland and Fremont, California; [7] Los Angeles and Glendale, California; [8] Providence and New Bedford, Rhode Island; [9] San Francisco and Redwood City, California; [10] San Jose, California; [11] Cambridge, Massachusetts and [12] Edison, New Jersey. The estimates are based on a report from the National Association of Realtors which watches home-selling trends across the country. The report noted that sales on existing homes—the precursor to new home sales—dropped 6% from January to May, 2006. According to Gannett News Service in a USA Today news story, the decline was the steepest drop in 11 years. The number of homes for sale rose sharply—a sign of slackening demand.

David

Lereah, the chief economist for the National Association

of Realtors [NAR] said he expects home sales to fall by as

much as 8% this year due to what he sees as more interest rate

hikes by the Federal Reserve—on top of a quarter-point rate

hike by new Fed Chairman Ben Bernanke on June 29. However,

Bernanke and the Fed bankers, who had been making tough

talk about raising interest rates to whatever level was needed

to curb inflation decided that the sudden slowdown in the housing

market had sufficiently cooled inflation fears. As he announced

the quarter-point spike,

David

Lereah, the chief economist for the National Association

of Realtors [NAR] said he expects home sales to fall by as

much as 8% this year due to what he sees as more interest rate

hikes by the Federal Reserve—on top of a quarter-point rate

hike by new Fed Chairman Ben Bernanke on June 29. However,

Bernanke and the Fed bankers, who had been making tough

talk about raising interest rates to whatever level was needed

to curb inflation decided that the sudden slowdown in the housing

market had sufficiently cooled inflation fears. As he announced

the quarter-point spike,  Bernanke

indicated the quarter-point raise in the prime, to 5.25%, would

very likely be the last interest rate hike unless inflation rears

its ugly head later in the year.

Bernanke

indicated the quarter-point raise in the prime, to 5.25%, would

very likely be the last interest rate hike unless inflation rears

its ugly head later in the year.

Wells Fargo senior economist Scott Anderson said: "We think the housing markets and the consumer cooling down will put a lid on inflation." Wall Street and the NAR were afraid, based on the Fed's rhetoric, that the housing starts would stall—which would likely bring down commodity and gasoline prices. Instead, Bernanke's statement caused gold and commodity stock prices to spike. The dollar fell, increasing the likelihood that oil prices will continue to rise (dispelling the myth that oil prices spike only when there are shortages) To keep the real estate boom alive—which, essentially, is camouflaging the job exodus from the United States and keeping the American economy alive—the Fed has to contain inflation without letting rising interest rates destroy the low cost, but highly risky, adjustable-rate mortgages that are keeping the real estate bubble from bursting. One-in-five mortgages today is an ARM. In another year, one-in-three will be an adjustable-rate mortgage. Most of those mortgages will reset on their anniversary date in one to three years at much higher rates. Over 50% of those who have ARMs will discover it will literally take an arm and a leg to make their mortgage payments—and most won't be able to. Those who are unable to refinance will be in jeopardy of foreclosure.

Even though the boom is basically over, as long as the economists can keep the balloon floating, the residuals will continue—a real estate boom with no reason for existing—and no end in sight as long as home buyers are willing to become distant commuters, moving farther away from the core urban centers where they work in order to stay ahead of the price bubble—doubling commuting time on the Interstates and Byways, and burdening mass transit systems. The bubble will burst only when new home buyers stop coming or inventories of unsold older homes begin to stack up like cordwood.

At the end of June, the average 30-year fixed rate loan was 6.7%—up from 5.57% at the same period in 2005. If a home buyer financed $230,000 at 6.7% the monthly payments (principal and interest, excluding insurance and taxes) the monthly payment would be $1,484.00. At 5.7%, the basic mortgage payment would be $1,316.00. If Cortney Henderson has an ARM mortgage, her mortgage payment may have increased by as much as $336.00 a month after only a year.

As the prices of new and existing homes skyrocketed, banks and mortgage companies were forced to create new financing packages to accommodate buyers since few people, using the traditional credit yardsticks, would have sufficient income levels to qualify for new home loans. For the first time in history, banks began offering 50-year mortgages. In San Diego, the real estate sink hole of America, 74% of the new home buyers received loans in which only the interest—and sometimes only a portion of the interest—were due the first year. One-, two- and three-year modified interest-only mortgage payments have become common place. Tragically, they will lead to record levels of personal bankruptcies before this decade is over.

Since

2000, the median price of a single family home has more than doubled

in at least 30 US markets. Home prices have risen by as much as

30% to 50% or more in other parts of the country. Even the most

depressed economic areas of the country have experienced spurts

in the real estate sector that are unjustified by the rest of

the economy.  However,

those markets offer homes that are reasonably priced. For example,

in Des Moines, Iowa, you can still buy a median-priced home for

$150,000. In Ocala, Florida that median-priced home is $160,000.

Still affordable considering that the same home in Sarasota, Florida

(just south of St. Petersburg) is $383,000. That same home in

Anaheim, California would cost you $713,000.

However,

those markets offer homes that are reasonably priced. For example,

in Des Moines, Iowa, you can still buy a median-priced home for

$150,000. In Ocala, Florida that median-priced home is $160,000.

Still affordable considering that the same home in Sarasota, Florida

(just south of St. Petersburg) is $383,000. That same home in

Anaheim, California would cost you $713,000.

In May, when the median price of a single family home (the average price in all markets nationwide) rose 6.4% to $228,000, existing home sales fell 1.2%—a foreboding sign of what was happening. As profits plummeted, the five largest home builders in the nation all agree that, nationwide, the boom has peaked although there are still "pocket" booms in various areas of the country where the "affordability crisis" is still forcing the urban exodus into less expensive rural suburban markets. Roughly twenty-nine percent of the residents of San Diego are not only considering moving out of the city, but out of the State, to find somewhere more affordable to live.

Biotech companies in San Diego have stopped interview job applicants outside of California because the California housing sticker-shock keeps most people from accepting jobs in a city where a "starter home" costs over a half million dollars. Most of those who live in places like San Diego, Sacramento, Foster City, Santa Ana or Los Angeles have never paid a super-inflated price for a home since they bought their homes long before the current wave of real estate inflation began. For example, homeowners who bought in Foster City, California when that planned community broke ground in the 1960s got a comfortable three-bedroom, one-bath home for about $22,000. Something bigger with four bedrooms and three baths would run about $50,000. Now that same four bedroom home in Foster City is about a million-two. Some appreciation—especially if you were the original buyer.

Talk to most Americans about the housing boom and skyrocketing home prices and the consensus will likely be that its simply the byproduct of the free enterprise system. In point of fact, it isn't. It's a direct result of market-tampering by government—and greedy businessmen. Blame it on Smart Growth. Blame it on the politicians who fashion the laws requested by those who filled their campaign coffers. Blame it on the bureaucrats that impose restrictive planning commission regulations on home builders—and the rezoning of farmland to artificially increase its value—and the tax assessments that force farmers to sell off land they can no longer profitably farm. But, most of all, blame it on the Utopians who claim what they are trying to do is create affordable housing for moderate income people. Nothing could be farther from the truth since the bureaucrats who created the housing regulations to expedite "affordable home" created the dilemma that resulted in "unaffordable" housing.

Ironically, the utopian planners blame the skyrocketing real estate prices on overpopulation and the demand insufficient housing creates. Nothing could be further from the truth. Skyrocketing real estate prices are the result of consummately selfish entrepreneurs, politicians and bureaucrats working together to rape the consumer. Overpopulation? San Mateo County, California was one of the top 20 real estate markets in the nation—now its the 9th most likely real estate market to implode. As housing prices pyramided since 2000, 9,000 families left San Mateo County. The same thing is happening in Anaheim, Boston, Cambridge, Framingham, Glendale, Irvine, Long Beach, Los Angeles, Nassau, Oakland Ontario, Quincy, Redwood City, Sacramento, San Diego, and Edison, New Jersey.

The people who are leaving aren't those who bought the super-inflated homes in the overheated markets. Those making the exodus are average wage earner homeowners who purchased their houses long before a $200 thousand house was selling for a half million to three-quarters of a million dollars—or more. Many of them live on fixed incomes—seniors who purchased their homes in the 1960s or 1970s. They bought long before the societal planners decided where people should live, long before the price wars began. Equally impacted are young families who purchased modest-priced starter homes in the commuter markets on the fringes of the eternally expanding, enveloping urban-suburban areas before the rural environs began to overheat. As home prices skyrocketed, so did the tax appraisals—and tax burden on both young and old with little, if any, discretionary income.

The biggest theft against the American homeowner has been perpetuated on the consumer by county's tax appraisers who make assumptions that because one home buyer is willing to pay 50% to 100% or more over market value to purchase a new or previously-owned home in a targeted-for-growth rural-suburban area that all of the homes in the immediate vicinity of the just-sold home in that market have proportionately increased in value. The tax assessors have arbitrarily decided that the aggregate worth of all of the not-for-sale homes cannot be based on what the owner paid for it, but what he could get for it if he sold it in an overheated cycle. It should come as a shock to no one that when the real estate bubble bursts, and what was previously a seller's market becomes a buyers' market, the tax appraiser will never reappraise the taxable value of your home below the price you paid for it—even if the lending institutions do. This is important, so let me say it again—when you live in an overheated real estate market, your property is taxed not based on what you paid for it, but what the real estate industry and the county government where you live thinks you could get for it if you sold it. When the market corrects itself—as it always does—how many times, do you think, the county has refunded the taxes they overcharged the homeowner? Stop and think a moment about how much the homeowner is being overcharged. If you lived in a market (other than California where property tax rates are fixed by law) where home prices rose 150% tp 200%, property taxes would have spiked appreciably. Get the picture? Would you have voted yourself a 150% to 200% county tax increase if such a measure had been placed on the ballot? Of course not. County government is using smoke and mirrors to generate the tax revenue stream they will need to build up the infrastructure of the county to support the influx of new human capital.

New consumers will feed the mushrooming economy by purchasing consumer goods. In turn, the artificially-stimulated economy will feed the municipal, county and State governments with additional tax revenues, allowing the bureaucracy at all levels to grow. This will encourage the societal planners to continue growing the peripheral rural suburban areas that are economically tied to the urban-suburban areas, thereby creating more jobs for the human capital—and more wealth for a handful of developers, merchant princes and industrialists who, in turn, feed the petty politicians with lucrative grants that are nothing more than "community bribes," and political contributions to perpetuate prosperity for a few and a ever-increasing tax burden on everyone else.

As the housing paradigm becomes an economic nightmare for modest income Americans, most of them—if they don't own a home now—will be financially out of the mortgage loop. Skyrocketing housing prices are shutting out middle-income wage earners faster than the bureaucracy can create new financing initiatives that will allow them to qualify for mortgages. Housing prices are reaching unsustainable levels. When that happens, like a proverbial house of cards, they will come tumbling down.

Over 12 million middle-income wage earners are now paying up to half of their adjusted gross incomes on mortgage payments. As home prices continue to escalate, theoretically the market value of all homes in the community increase proportionately. That paper value is called equity. Equity is paper profit that doesn't exist because it isn't real unless you sell your home. Unfortunately, equity also translates into a bigger tax bite since the taxes on your property are based not on the price you paid for it, but the perceived value if you sold it.

The scary version of the runaway market scenario is that when the real estate boom peaks in a region, home prices should begin to correct themselves by dropping 5% to 10% a year. But they haven't. They appear to be continuing to rise at a rate of about 5% per year. The consequences of the housing paradigm is reshaping Americana in a way that will not benefit low to low-middle income wage earners. Coupled with rapidly escalating property taxes, skyrocketing insurance costs—and dramatically increased fuel costs for commuters who have even farther to travel to their jobs in the more dense urban-suburban areas.

The problem is compounded by Smart Growth planners who zone major quadrants of land "off limits" for building. Doing so artificially inflates the price of the available land, and home prices spiral dizzily upward since it is the land, not the dwelling, that makes housing astronomically expensive. In most major markets—particularly those with rent controls—landlords are converting apartment buildings into condos, creating severe rental shortages. In San Diego, apartment vacancies are around 2%. Apartment owners are still trying to covert their buildings into condominiums even though thousands of prospective tenants are on waiting lists for an apartment.

A few years ago, after her husband died, eighty-year old San Diegoian Juliane Anton—like many senior citizens all over the country—sold her home and moved into a downtown apartment because it was more convenient and it was maintenance-free living. The owner of the apartment complex evicted her because he wanted to sell the apartments as condos. In fact, in San Diego, apartment owners have petitioned the San Diego Housing Commission to convert an additional 16,000 apartments into condos. Anton moved. Now, her new landlord is doing the same thing. Anton said after she pays her $1,250.00 monthly rent for her small 2-bedroom apartment, she has $150.00 of her Social Security check left. Her medical insurance—after Medicare—eats up what's left. She lives on her savings—the "windfall" from selling her home in a boom market. Anton is one of the lucky ones.

Many elderly people aren't so fortunate. Far too many elderly people have no savings to speak of with which to meet their obligations when their Social Security checks runs out around the 10th or 15th of the month. Most of them in the overheated real estate markets couldn't afford a nice two bedroom apartment in an upscale part of the downtown area. Most of them struggle from month to month in rent-controlled one bedroom apartments or, in some cases, in a one-or two-room apartment with a shared bath. In many cases, those cheap living quarters are targeted for eminent domain seizures, bulldozed and replaced with expensive condominium complexes that the former tenement occupants could not afford. While its true that many of the razed buildings were blighted eye sores, they nevertheless provided a roof over the heads of the former occupants. This is part of the affordability crisis.

In the overheated markets the bureaucracy attempts to solve the problem by mandating that in high density condominium and town house communities, the developers set aside a certain percentage of the units for low income families under programs where the State or federal government establish housing trust funds that offer financial aid to low income wage earners. In most superheated markets, societal planners built regulations into the zoning laws that require developers to provide a certain percentage of low-income housing in every town house or condominium community they build.

Just five years ago affordable housing was so plentiful that most Americans took home ownership for granted. It would be there when we wanted it. Many young couples rented because, starting new careers as they started new families, most worked for companies that would transfer them two or three times before they settled into their permanent jobs. It would be pointless to buy a home, only to have to sell it a year or two later. Now, affordable housing for many will be a wistful memory: "Wow...do you remember when a house like this cost less than that a Cadillac?"

Copyright © 2009 Jon Christian Ryter.

All rights reserved.